A slightly longer read as we have a lot to talk about.

The 21_22 financial year has been and gone and it was definitely two very different six monthly periods.

Looking back over the twelve months, the markets, somewhat surprisingly, strengthened from 1 July 2021 to 31 December 2021. It was a difficult market to read as earnings forecasts post Covid19 may have been understated and this was driving expectations. We discussed this in our blog at the time and the concern was the unknowns such as interest rates and inflation.

In January 2022, we came back to a lot of uncertainty and then in February, Russia invaded Ukraine and suddenly those interest rates and inflation rates we had been discussing became very significant.

In March we saw the rerating of some very extravagantly priced US technology stocks and that led to a general revaluation of the market and future potential earnings.

Since then we have seen markets reacting to supply chain issues, inflation announcements, geopolitical sabre rattling and ultimately interest rate rises.

So just when you thought it couldn’t get any worse!

In the month of July, we saw the ASX 200 (Australian Share market) recover by 6% and the S&P 500 (US markets) recover by almost 8%. The UK FTSE was up by 3.5% and the Euro STOXX 50 was up over 7.5%.

What the….?

Alright, so this is the part where we remind investors that the market reacts to future predictions so it’s more about future forecasts than what is currently happening.

Is inflation still at record levels?

Yes, but there is an argument that six months from now, supply chain issues may have eased. The Chinese Zero Covid policy continues to impact a large bundle of goods and locally, heavy winter rains have pushed up the grocery bill. The other big impacts have been interest rates, energy costs and fuel.

Covid and rains can be navigated but what about those energy costs.

The exciting world of UREA.

The world runs on diesel. Whether its ships, trucks, trains, tractors or delivery vans, moving large volumes of goods around the world, they are reliant on diesel. Diesel also needs an additive ‘Adblue’ which is reliant on Urea. This is used in diesel vehicles for removing nitrogen oxide from exhaust to conform with vehicular emissions restrictions.

The world’s largest exporters of Urea are…. Russia and China, followed closely by Saudi Arabia, Qatar and Egypt. That might give you a suspicion of the problem.

- China, until they banned exports in 2020_21, supplied 80% of Australia’s needs. They banned exports for everyone so Australia doesn’t have to feel special in this case. World’s largest exporters of Urea.

- Urea is also used in fertiliser and the demand for use as a fuel additive was putting pressure on fertiliser costs. China has a large population to feed so keeping their Urea at home to fertilise their crops has helped keep their food prices down.

Our farmers unfortunately have the unhappy trifecta of very expensive fertiliser (the lack of availability is impacting produce quality and volume), expensive diesel and the cyclical ‘La Nina’ weather pattern that has given us above average rainfall in 2021 and early 2022. El Nino and La Nina explained BOM.

- The weather pattern has a high probability of reoccurring over our summer so there may be more rain to come. ENSO Outlook This can be good in the long term but can cause damage to crops and difficulties in harvesting in the short term.

Therefore, Urea shortages are impacting on diesel and the potential yield of our crops.

Australia was also about to lose our one Urea plant in Brisbane as they could not be guaranteed a reliable gas supply necessary to create the Urea. The previous federal government sorted this and announced a new WA plant in Geraldton partnering with Strike Energy Ltd (A $3billion project).

Crude oil has had its own problems.

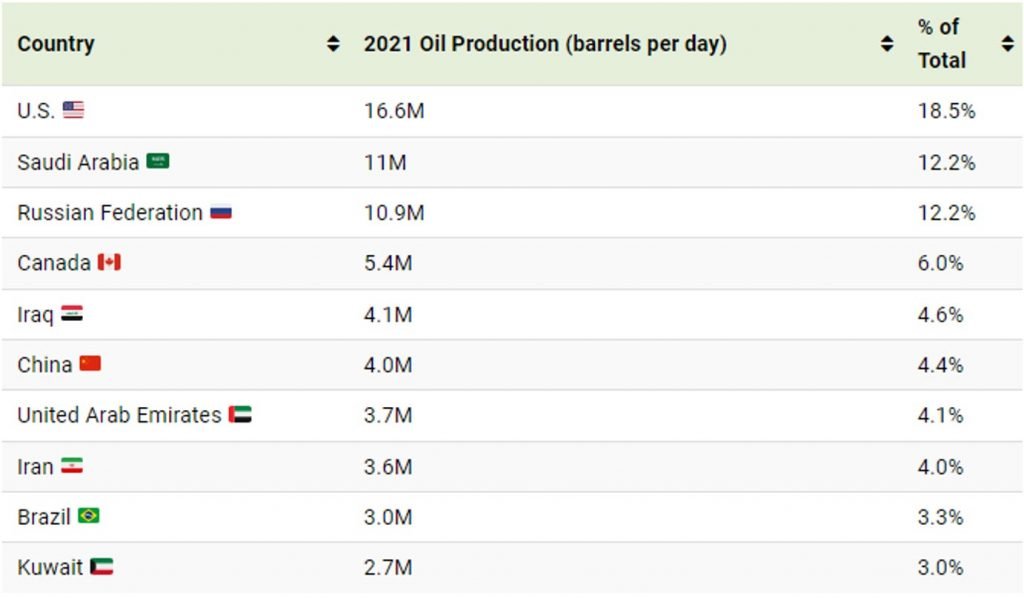

The Russia/Ukraine conflict has impacted supply chains for oil. Russia is not the largest oil producer but they are in the top three.

Additionally when you talk about the largest oil exporters, Russia are the second largest after Saudi Arabia. World top ten oil exporters.

The Largest Oil Producers in 2021

Roughly 43% of the world’s oil production came from just three countries in 2021 – the U>S, Saudi Arabia, and Russia. Together, these three countries produced more oil than the rest of the top 10 combined.

The invasion of Ukraine has seriously disrupted the oil supply and the world is relying on Saudi Arabia to pick up their supply. That would be a good opportunity to gouge wouldn’t you think? So they did!

- The price of oil on the 5th of August 2021 was USD$54.69 a barrel. On the 8th March 2022, the price per barrel peaked at USD$123.70, and stayed high all the way to the 8th of June and has now, 3rd Aug, dropped to USD$94.13.

That is what we have seen at the petrol pump.

- Prices are lower at the moment but on the 28th of September the fuel excise cut introduced on the 29th of March will be removed and that will add 22.1cents per litre.

We could spend a bit of time talking about Australia’s massive oil reserves and lack of oil refineries but that would just frustrate our readers?

Needless to say, fuel prices will take a nasty hike in about 7 weeks so any savings that are currently being made will disappear for a period.

Energy costs:

Energy costs have been discussed broadly in the media and in my last blog. Frankly, we have little control over them. Our underinvestment in our base load supply through our energy grid has become chronic. Any chance of boosting manufacturing to take more control of our supply chains is not looking good.

In the near term there are no solutions so this will continue to add to the cost of everything we do, use or buy. This part of the inflation mix will be with us for a long while.

Interest rates:

This is where there is some good news… in the future and what is leading to some small market rallies.

Rates are rising and this will likely have the impact the reserve bank wants to achieve.

Counterintuitively, rising interest rates are a reflection of a strong economy. The rates have been kept at artificially low levels to stimulate the economy. Yes, they should have been raised earlier but no matter when they started this change, there was going to be resistance and economic pain for the consumer.

Rising interest rates are being introduced to slow our growth and take pressure off inflation. It does this in number of ways:

The property market.

Australia does not have a big manufacturing employment sector so we tend to have very low unemployment when property is booming. A lot of semi-skilled and unskilled jobs are available and this reduces unemployment queues. Countries like the US and China rely more heavily on manufacturing to reduce unemployment.

Inflation has hurt property developers and their clients. Metricon and Condev are local examples and we have seen much bigger examples in China with Evergrande and Shimao.

- A slowing property market can slow the economy – the downside is increased unemployment and possibly increased rental costs in a very tight market.

- Softening property prices also impacts on sentiment and consumers are less likely to spend if they are concerned about their net wealth.

- Rising interest rates reduces household discretionary income. This reduces spending and eases supply chain pressures. Consumers think more carefully before buying large items like vehicles or appliances.

This sounds bad but it’s what the Reserve Bank and central banks around the world want to achieve. By reducing spending pressure, the supply side will increase. More supply to fewer buyers, brings prices down and then that inflationary basket of goods gets cheaper. Inflation eases.

Recession fears reduce.

There is a lot of discussion about the ‘R’ word. Australia ‘arguably’ has not seen a recession since 1991 – 31 years. A recession is two negative quarters and despite some ridiculous rhetoric, the US has now had that, so is technically in recession.

The reason I say arguably for Australia, is we have often felt like we were in recession, despite not meeting the technical definition. We first started hearing about our ‘two speed economy’ back in 2004 and more recently in 2011. The two speed comment relates to having a booming mining and export sector with a lagging domestic sector. To those not in the export sector, it was a recession.

So most Australian workers have already lived through recession like periods and yes, we got through them. The problem with the myth that we ‘technically’ have not had one in 31 years means if we do roll into a recession, this will have a bigger impact on the psyche of the consumer than it should.

If we can avoid it, which looks more positive now than a month ago, it can mean investment markets can see earnings growth, not too far down the track and hence the July rally.

A final word:

We are not out of the woods yet.

We may have seen some positive movements but we are still susceptible to shocks.

- Nancy Pelosi’s trip to Taiwan will have some ramifications.

- The energy crisis in Europe is not resolved and we are edging into Autumn and Winter.

- China’s Communist Party (CCP) are struggling with the need to restart their export industries and flexing their pacific military dominance.

- Covid has hurt their economy and their domestic vaccines are not proving as effective as the West’s.

- Investors are very wary of the CCP’s influence and that has slowed capital investment.

- We actually don’t have a historic playbook to look at in regards to the way the world has managed this pandemic. We shut, hibernated with massive stimulus, and then reopened our economies. We haven’t seen that in the last 100 years so there are variables that may impact us that we are yet to see.

However:

- We have almost full employment;

- We have strong wages growth;

- Our Gross Domestic Product growth is forecast to be 3.6% for FY 21_22;

- We have record trade surpluses thanks to our coal, iron ore and agriculture;

- We have pent up demand for travel and experiences;

- We have increased household savings from the pandemic; and

- We still have very low interest rates. I wouldn’t call 1.85% high?

We have analysts who are very pessimistic and we have others that are cautiously optimistic. Our view leans towards pragmatic.

- Look for good quality investments that are undervalued and will be worth more in the future.

- Don’t focus on the next three to six months which are likely to be volatile. Look at three to five years and where the potential is.

- Be prepared to move quickly if the environment changes but don’t let fear or greed drive your decisions.

In the meanwhile, we have the Commonwealth Games and that gives us real life changing stories every day. Enjoy watching all that hard work pay off for so many talented athletes and you can leave us to worry about the investment markets.

As always if you have concerns, please do not hesitate to contact us.