In our May release we discussed inflation hurdles, rising interest rates, geopolitical concerns and energy wars.

This article considers the investment backdrop and what is happening out there.

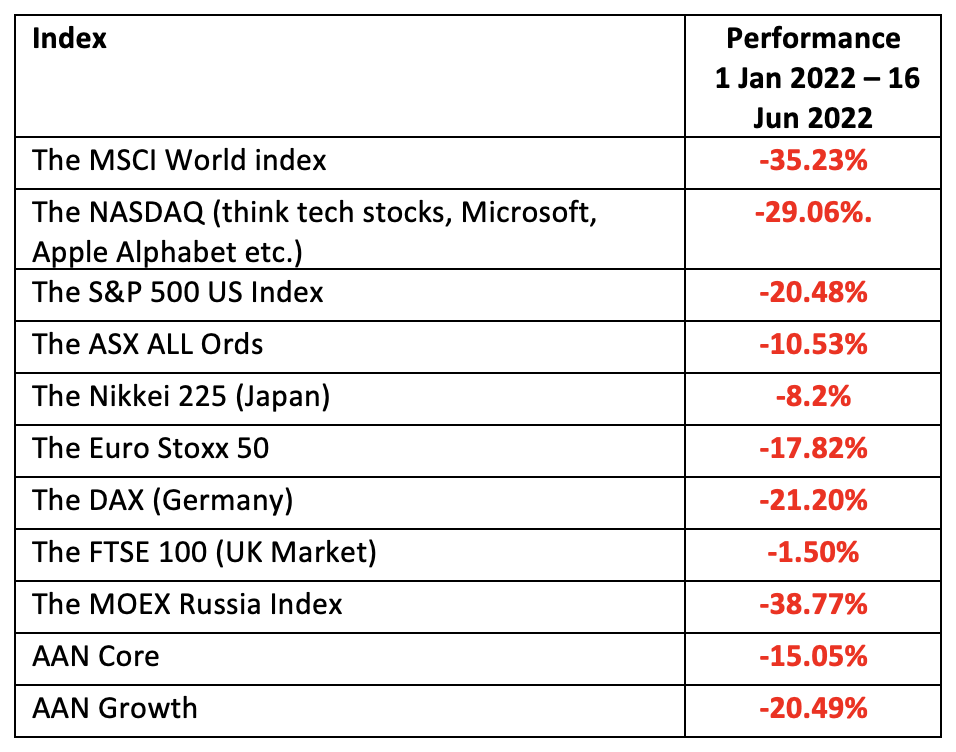

My quick summary of what has happened in investment markets since 1 January 2022 (the following numbers are to 16 June 2022):

Yes, definitely a sea of red, and no Moses to carve a way through it. Unfortunately, the world’s asset markets had additional problems.

When you construct portfolios, you use both growth and defensive assets. Our shock absorber (the Diversified Real Return Fund – part of the defensive pool) did exactly what it was meant to do and was actually pretty close to zero through this period (slightly up at the end of May) but it is only 20% of the Core and 10% of Growth. The other defensive sectors are cash and bonds and the lift in interest rates saw the bond index lose over -12%. (Definitely very un-bond like but not unprecedented).

When both growth and defensive assets are all in reverse, portfolio management does become difficult.

Our concerns on interest rates meant that our exposure to bonds was very ‘short duration’ so that portion of our portfolio had a return of less than -2.96%, much better than the return above but still a negative so not offsetting losses in the growth portion of the asset mix.

The other difficulty has been that our active international manager and our two active Australian equity managers had a high level of exposure to growth style shares*. (These shares have a strong growth profile. They may not pay a lot of dividends as they are reinvesting in the company but the share price shows a healthy progression). This has provided excellent returns over the last five years.

*The use of the term ‘Growth style’ might confuse readers here. The major styles of equity management are Value, Growth, Passive (Index) and Growth at a reasonable Price (GARP). Our growth/defensive mix remains the same – this speaks to the style of asset selection the manager utilises.

The disruption in interest rates and then the Ukraine conflict saw a rush to value style stocks. Suddenly resource and energy companies that had shown little to no share growth became the new darlings of the market. There was nothing wrong with these shares – they are good well managed companies – but their profile was fairly stagnant and they have been struggling to generate new investments.

Without getting too complicated and getting into how shares are classed as ‘growth’ verses ‘value’, the indexes that give the clearest picture are the MSCI world indexes. For the period 1 Jan 2022 to 31 May 2022, the world ‘Value’ index drop -7.13%. The World ‘Growth’ index dropped -25.0%. The upshot was the active portion of our portfolios was actually underperforming their relevant indexes for the first time in five years.

Our managers did better than the Growth index but we (and you) would have far preferred the Value experience.

The Financial Year to date numbers (1 Jul 2021 to 16 Jun 2022) were AAN Core -10.17% and AAN Growth -14.0%.

So, the above looks like a lot of excuses but what did we do?

(And yes there was a lot going on behind the scenes)

Your model managers have not been idle over this 21_22 financial year, and regular readers of this blog will know we had ongoing concerns about inflation and interest rates.

As far back as 30 June 21 we started addressing interest rate concerns and reduced our exposure to longer dated bonds by 50%. I don’t want to dwell on the technicalities of this but ultimately it reduced the negative impact Bonds have caused this year.

In 31 December 2021, we further reduced this to very ‘short duration’.

In 31 March 2022, we reduced our ‘growth’ exposure to Australian equities by reducing Bennelong and Hyperion holdings and adding an exposure to the Australian ‘Top Twenty’ shares. This gave us exposure to the ‘Value’ style shares (eg. Financials, resources and energy).

Bennelong and Hyperion were then both under review and while we respect and value both managers, ultimately we withdrew our position in Hyperion in May 2022 and increased our exposure to the Top Twenty. These are good managers and will no doubt recover but our strategy here was to reduce volatility in the immediate term and then source a longer-term solution.

We are currently negotiating with a very well respected manager who will build a hybrid style equity portfolio to manage our exposure to value style assets. This will be rolled out in the new financial year and in the interim, the Top 20 portfolio has already substantially smoothed the performance from 1 April.

A couple of big questions from our clients:

Have we seen the worst of this?

Interest rates are going to continue to rise and the market has priced this in. There is a sound argument to suggest that the market has overdone the reaction to rate rises and if we ignore the media headlines, maybe a bit of common sense may return.

The Australian cash rate has moved from 0.10% to 0.85% in the last two rises. Most Australians have seen rates far higher than this and all the hand wringing and predictions of doom may be a little overdone. As previously mentioned, we can see rates getting back to some sort of normal 2-3%, but this will be staggered over time.

Potentially, this will put the brakes on the economy and inflationary concerns will stay as long as we have supply issues and the underlying issue of Adblue shortages for diesel fuel pushing up transport costs.

Demand for our energy will actually increase into the northern autumn and winter as it is unlikely European countries will see trade with Russia returning to normal in this calendar year and maybe for many years to come. This will keep pressure on energy prices so some inflation, along with wage rises, will be baked in.

Typically, markets do overreact and we, and the consultants we work with, are still cautious in the short term but can see a more positive environment in the late part of this year and moving into 2023. There is still a huge amount of additional saving in the system from Covid stimulus and that should help us weather the downturn caused by interest rate rises.

Will I see my investments recover?

In these sort of periods, it is difficult to see how quickly things can rebound.

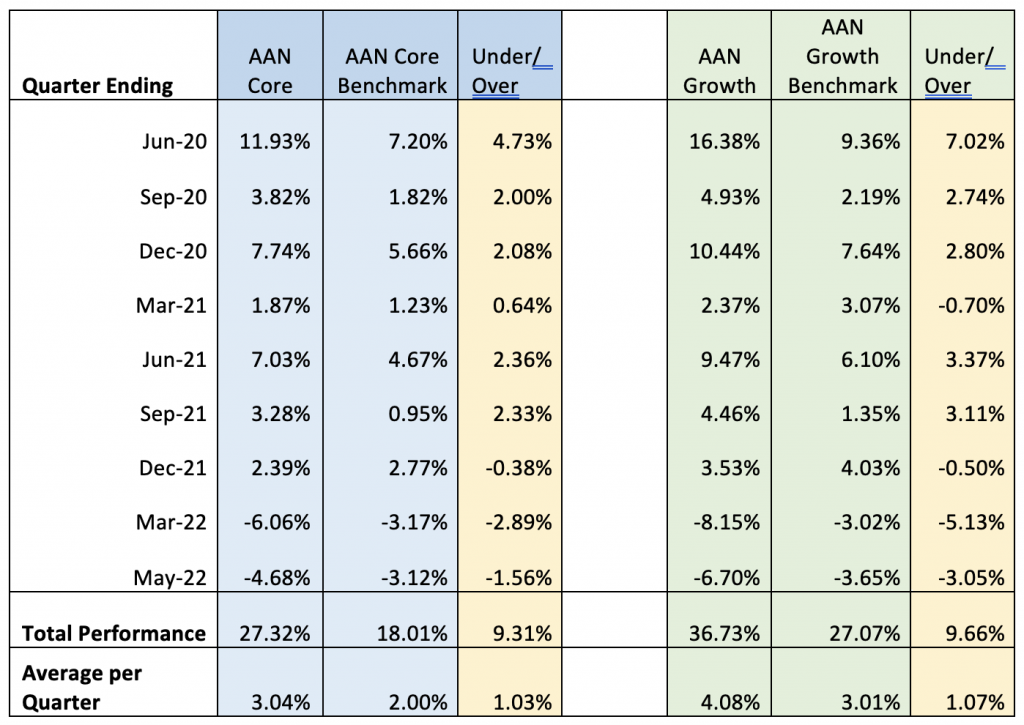

The table below is the quarterly returns for our model portfolios over the last three years:

*Performance since March 2020 to May 2022 the last month end data available.

Just as we can see negative performances, you can also see how much upside can occur in a given quarter.

- For those with money to invest, this is actually a good time to invest as great quality growth assets are cheap.

- For those invested, we will still see volatility but a lot of the initial shock has been translated into the current market valuations.

Our retirees generally have two years of cash so can give assets a chance to recover and accumulators can continue to invest knowing a lot of the noise currently in the market is likely to drop out once interest rates settle into the next normal.

Still some volatility to go but we are well positioned for any recovery.

As always, if you have concerns, please do not hesitate to contact us.

Yours Sincerely,

The RFS Team