Written by Quilla Consulting

Key takeaways

- A Trump victory is expected to bring market friendly policies that will be positive for equity markets, using the same playbook from his first term as President. Tax cuts and other fiscal stimulus will likely be inflationary, pushing the US dollar and bond yields higher for longer.

- We expect the Trump White House and Republican Congress will look to enact an expansive policy agenda. It is unlikely the Democrats will be able to prevent the conservative policy agenda given the Republicans unified control of government. This will have distinct winners and losers with financials, energy, and healthcare companies benefiting the most. US small caps stand to benefit as they are more cyclical and domestically focussed.

- The possibility of protectionism/tariffs is likely to have a negative impact on European and Emerging Market economies, with this flowing through to their equity markets. These markets are more reliant on manufacturing with the United States being a key export market.

Chart 1 – Investors quick to price in winners and losers

Source: Refinitiv, November 2024

What policy priorities do we expect from Trump?

We expect Trump will put forward a market friendly, populist and ‘America first’ economic agenda. This will likely promote American manufacturing, energy and re-shoring, while cutting taxes and regulations for domestic businesses. These will be well received by the market, especially any reduction in corporate tax with a 15% rate being a likely target.

We expect broad-based de-regulation from a Republican congress, with beneficiaries likely within banks and energy companies for whom regulation is a significant cost.

Republican control of both the house and senate appears likely, so wish-list items are on the table including a possible repeal of the Affordable Care Act, known as Obamacare. What might replace Obamacare is unclear, however a sensible assumption would be a more market-friendly approach that could be looked upon favourably for pharmaceuticals and health insurers.

What is the impact of possible Trump Tariffs?

Trump has been consistently in favour of tariffs since at least the 1970s. His first term featured implementation of protectionist policies notably against China but also Europe and other key trade partner nations.

Therefore, we expect a more aggressive protectionist agenda, with Trump himself proposing a fairly extreme 10% tariff on all imports along with a punitive 60% on Chinese imports. This is a maximalist agenda for possible future negotiations. Importantly, Trump can likely implement tariffs without Congressional approval.

Higher tariffs will have the effect of increasing inflation, higher interest rates and weaker economic growth. There could be retaliation on US companies in event of a trade war, possibly through tariffs or other punitive methods. Specific losers could be retailers, auto-manufacturers or companies with a significant Chinese or Mexican supply chain.

Congressional make-up

Republicans took control of the Senate (as expected) with wins in Montana, Ohio, Pennsylvania, and West Virginia, and a possible pick-up in Nevada. At the time of writing, it seems likely the Republicans will hold at least 53 seats in the Senate to Democrats 47, providing the party a buffer to pass more controversial bills.

In the House of Representatives, it is likely the party has grown their majority and given some much-needed stability to House Speaker, Mike Johnson. This should translate to a fast pace of bills being passed ahead of the 2026 midterms.

Government borrowing and fiscal deficits

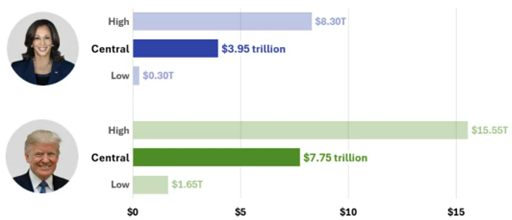

The Centre for Responsible Budget has projected Trump’s campaign promises would lead to a larger budget deficit of US$7.8 trillion cumulatively by 2035, with roughly US$5 trillion of that coming from extending and increasing the previous Trump tax cuts. While both candidates had large commitments to new spending or tax cuts, the bigger projected increase to the budget deficit under Trump is very notable.

This raises obvious questions about the sustainability of US fiscal spending and will almost certainly put sustained upward pressure on US bond yields which will have flow on effects for other markets.

We therefore expect that bond yields, while already having responded to the immediate news, will continue to move higher. We see a 5% rate on the US 10-year government bond as coming into view as a possible near-term target. Without spending cuts to offset the promised tax cuts, we see the return of ‘bond vigilantes’ as a force in the market – these investors typically sell bonds and force up bond yields to push back against irresponsible fiscal policies. At a certain point, equities will begin to be impacted by higher rates, starting with those sectors that are highly sensitive to interest rates, including property, utilities and other longer duration sectors.

Chart 2 – Fiscal impact of Harris & Trump campaign plans (2026-2035)

Source: Committee for a Responsible Federal Budget, November 2024

Relief rally for markets

Trump’s ‘red sweep’ means we are incrementally more positive on equities. US equities represent the most attractive market globally, with better prospects for earnings growth and a strong economy.

Trump tax cuts will drop directly to the bottom line for US corporates which will further bolster US earnings. Confidence should rebound for both corporates and investors, potentially resulting in more deal-making (M&A, IPOs) which would benefit private equity funds looking for an exit. Hard assets, such as gold and bitcoin, also stand to benefit if inflationary pressures reignite, although this may take some time to play out.

US bond yields have already jumped higher due to a likely larger US deficit. This will have a negative flow-on impact for ‘bond-proxies’ including property, infrastructure and defensive equities. Crucially, rising bond yields will eventually hit a level which upsets the equity rally. We also expect ex-US equities will be out of favour as markets speculate on potential tariffs.

While this election is more consequential than most given Trump’s emphatic victory, we do think that markets can get ahead of themselves in many cases. Historically, we have seen strong positive returns in the year that Republican governments were elected with more muted returns there-after.

Winners

- US large and small caps

- US credit

- US dollar (in the short term)

- Gold

- Private equity

Losers

- Government bonds

- EM equities

- European equities

- Real assets such as property