Stock markets around the world have recently suffered some sharp market movements.

In Australia, for example, the All Ordinaries index fell 5.8%, from 8343.8 to 7859.4, in early August – although, over the next 10 days, it rebounded 2.9% to reach 8083.8.

In the US, the S&P 500 index fell 6.1%, from 5522.3 to 5186.33, at about the same time – and then, over the next 10 days, jumped 6.9% to 5543.22.

Both indexes, it should be said, were higher in mid-August than at the start of 2024.

Stock markets are notoriously volatile. Unfortunately, though, one of the realities of investing is that higher returns go hand in hand with volatility.

You can eliminate volatility by putting your money in a term deposit: that way, you’ll know exactly what your payout will be at the end of the term. But the trade-off for that smoother ride will almost certainly be a lower return: right now, you’d be lucky to get an interest rate of 5% for a 12-month term deposit.

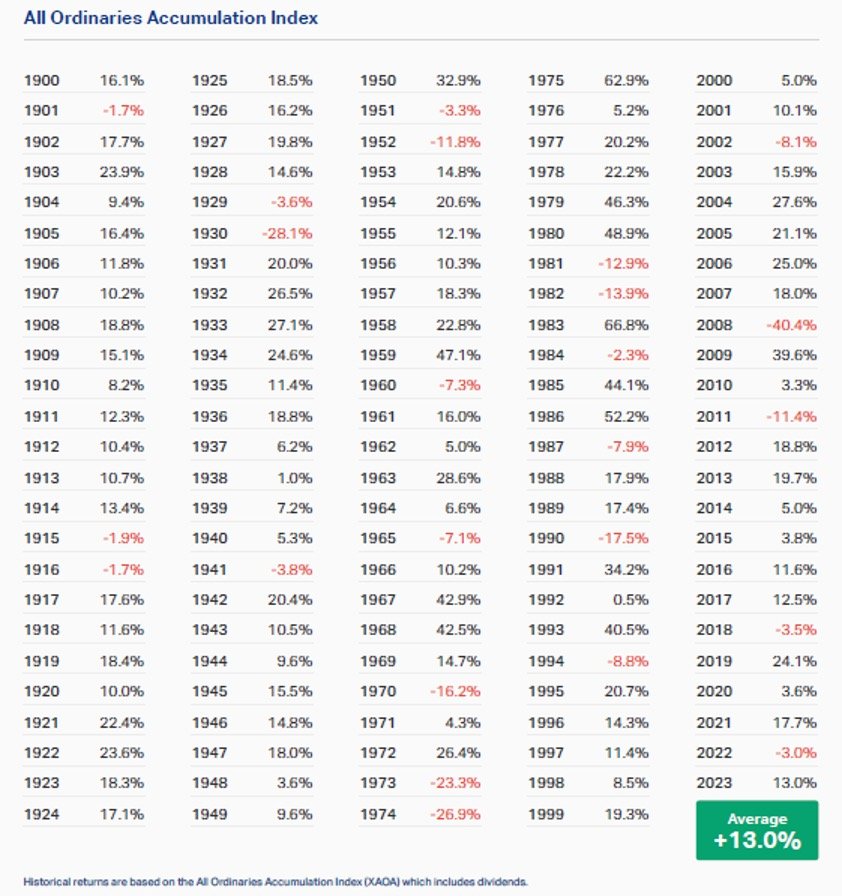

By contrast, equities have historically been much more profitable, at least over the long-term. Since 1900, Australian shares have delivered an average annual return of 13.0% (including dividends), according to Market Index.

The key word in that previous paragraph is “long-term”, because the market never goes up in a straight line.

In the 124 years since 1900, there have been 100 that have delivered a positive return and 24 that have delivered a negative return. And even in those positive years, there were always periods when the market went backwards. (The ASX200 has suffered an average intra-year drawdown of 14.0% over the past 30 years, according to J.P. Morgan Asset Management.)

How to protect yourself from volatility

As mentioned earlier, it’s not possible to enjoy those high returns without accepting volatility.

There are, however, some steps you can take to protect yourself.

First, be diversified: invest in a range of asset classes and make sure they’re non-correlated (i.e. respond differently to market conditions). For example, shares and bonds often deliver contrasting returns: a stronger market for one tends to correlate with a weaker market for the other. You can achieve further diversification by investing in different geographies (such as both Australian and US shares) and different assets within each asset class (such as multiple companies, in multiple sectors, in both countries’ stock markets).

Second, re-weight your portfolio on a quarterly basis, to ensure it remains balanced and diversified, and aligned with your goals.

Third, adopt a long-term mindset. As the data from the past 124 years show, the market has delivered strong long-term returns, despite regular corrections along the way. Past performance is no guarantee of future performance – but if history repeats, that would mean, after every future correction, that the market would eventually achieve a new high. So when the market goes backwards, it’s important not to panic. If you have a sound investment strategy, it’s generally a good idea to stay the course.

The stock market transfers money from the active to the patient

When the market suffers one of its periodic corrections, it’s natural to feel that you should immediately react in some way.

Often, though, the best response is to do nothing; to play the long game instead.

As Warren Buffett, arguably the greatest investor of all-time, once said: “The stock market is designed to transfer money from the active to the patient.”

Remember, higher returns go hand in hand with volatility. The recent drawdowns – and quick rebound – are all part of the natural order of things.