The rapid rise of interest rates has provided a shock that is exposing companies with pre existing conditions to the rude reality of normalised monetary policy.

Yes the US Federal Reserve cash rate rises from zero in March 2020 to 4.50% in March 2023 is the steepest rate rise cycle for 158 years but… 4.5% is not an outlier when it comes to cash rates.

We have seen two bank collapses in the US (SVB we discussed in the last blog and the other was Signature Bank) and the much bigger headline was the collapse of Credit Suisse in Europe.

We did mention in the last blog that the US has a very large number of banks – almost 4000 plus including merchant banks – and regional bank failures are not that unusual. In fact, the lack of failures in 2022 was unusual. US regional banks on average have up to two collapses a year.

Australia has 97 well capitalised banks that are subject to quite stringent lending guidelines and capital adequacy requirements as well as being monitored closely by a fairly aggressive regulator. No analysts are raising concerns about our banks stability.

So why after 167 years of existence did Credit Suisse fail?

Short version – interest rate rises were the straw that broke the camels’ back but it had a lot of problems.

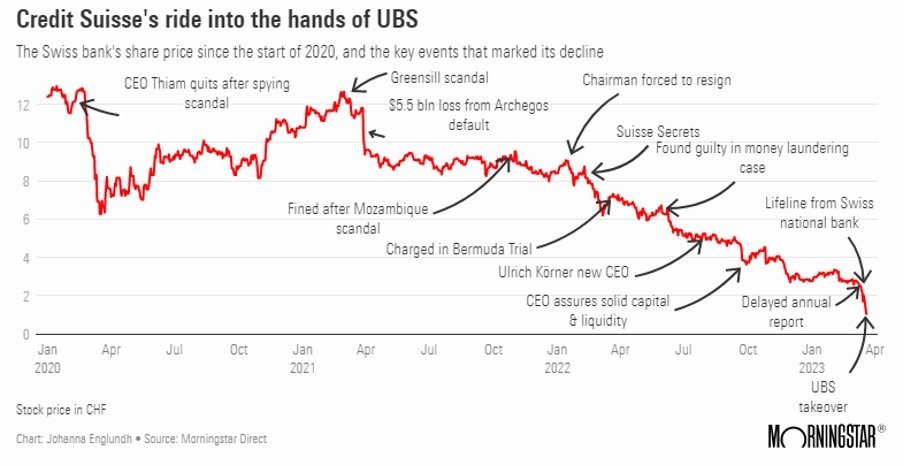

Before its collapse, its share price had dropped by 94% over five years and below are just some of the reasons why.

Feb 2020: A scandal about the CEO spying on a staff member who moved to UBS turned into a broader exposure of spying operations from 2016 to 2019. The CEO resigned.

March 2021: Credit Suisse was heavily invested in British Firm, Greensill Capital which collapsed leaving Credit Suisse with a $10 billion headache (nytimes/2021/03/28/greensill-capital-collapse.html ).

March 2021: US Family office Archegos defaults costing Credit Suisse $5.5 billion.

Needless to say, the Swiss regulator FINMA, took a very dim view of Credit Suisses internal governance.

October 2021: Credit Suisse caught up in a Mozambique bribery scandal and fined $475 million by US and British authorities.

January 2022: Someone leaked details of dozens of entities including drug lords, sanctioned business identities, intelligence officials and even heads of state that stashed cash in Credit Suisse accounts that Credit Suisse could easily have verified were involved in human rights abuses, drug trafficking, corruption, money laundering etc. (suisse-secrets-interactive – partial list)

June 2022: Switzerland’s Federal Criminal Court found Credit Suisse culpable in not preventing a money laundering scheme by a Bulgarian cocaine-trafficking ring. This cost them a $2.1 million fine. A former employee confirmed that Credit Suisse continued to manage the funds even after finding out the source.

October 2022: The new CEO announced a plan to cut 9,000 jobs and raise $4 billion in fresh capital.

The final nail in the coffin was its March 14 annual report that admitted material weaknesses in its financial controls.

The schematic from Morningstar since Jan 2020 gives a little more depth:

Over 5 years its share price had dropped from 14.39 Swiss Francs (CHF) to 0.83 CHF:

So, yes the recent interest rate rises contributed to the failures of SVB and Signature Bank in the US, though arguably it is their lack of risk management and interest hedging that was exposed by the rises.

Credit Suisse was a very different case and when analysts, post the US failures, explored the global market for other banks that may have issues, Credit Suisse was quickly on their radar.

The silver lining to this as Shane Oliver, the economist from AMP Capital was discussing today, is that central banks would see these bank failures as an indication that their monetary policy of raising interest rates is having the desired effect.

Banks will be reviewing their lending policies, tightening up credit access and funding investments that can achieve short term cash flows for investors rather than a great new innovation that may or may not create a revenue stream in ten years’ time.

He would argue that these sort of events would indicate to central banks that inflation is nearing its peak and they would be getting to the turning point for interest rate policy.

We might have a little way to go but we are close to the top.

Volatility is still alive and well in these markets and we may see more business failures in coming months, but it is likely that their demise has only be exacerbated by this cycle, rather than caused by it.

The managers we use were nowhere near Credit Suisse as it failed on many fundamental metrics and businesses that are hitting walls in this market generally have high levels of debt that has been a concern for some time.

Market sentiment will still cause fluctuations but quality companies will recover faster and actually take advantage of the uncertainty.

As always, if you have any concerns, please do not hesitate to contact us.

Best regards,

Paul Forbes, RFS Advice CEO.