Play 4CRB Radio Segment: Can I Handle Market Volatility with Troy Theobald of RFS Advice

Market volatility – So what is it?

In relation to shares or superannuation, volatility is in the daily movements in share price of the underlying investments. They move each day and minute that the markets are open, as it’s a free market. Think of it as the lowest price someone is willing to sell their shares for; this is what the purchaser is paying.

Most movements in share prices derive from short-term global events, whereas the medium to longer-term changes often come from the characteristics of the individual companies.

So, why accept market volatility?

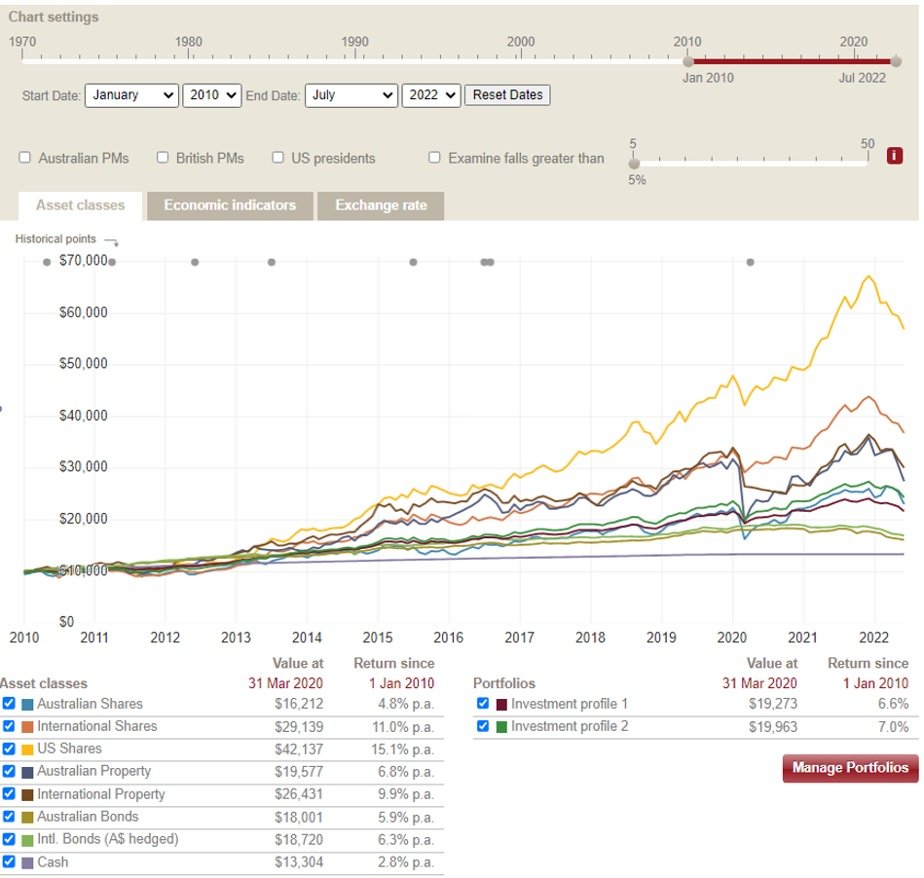

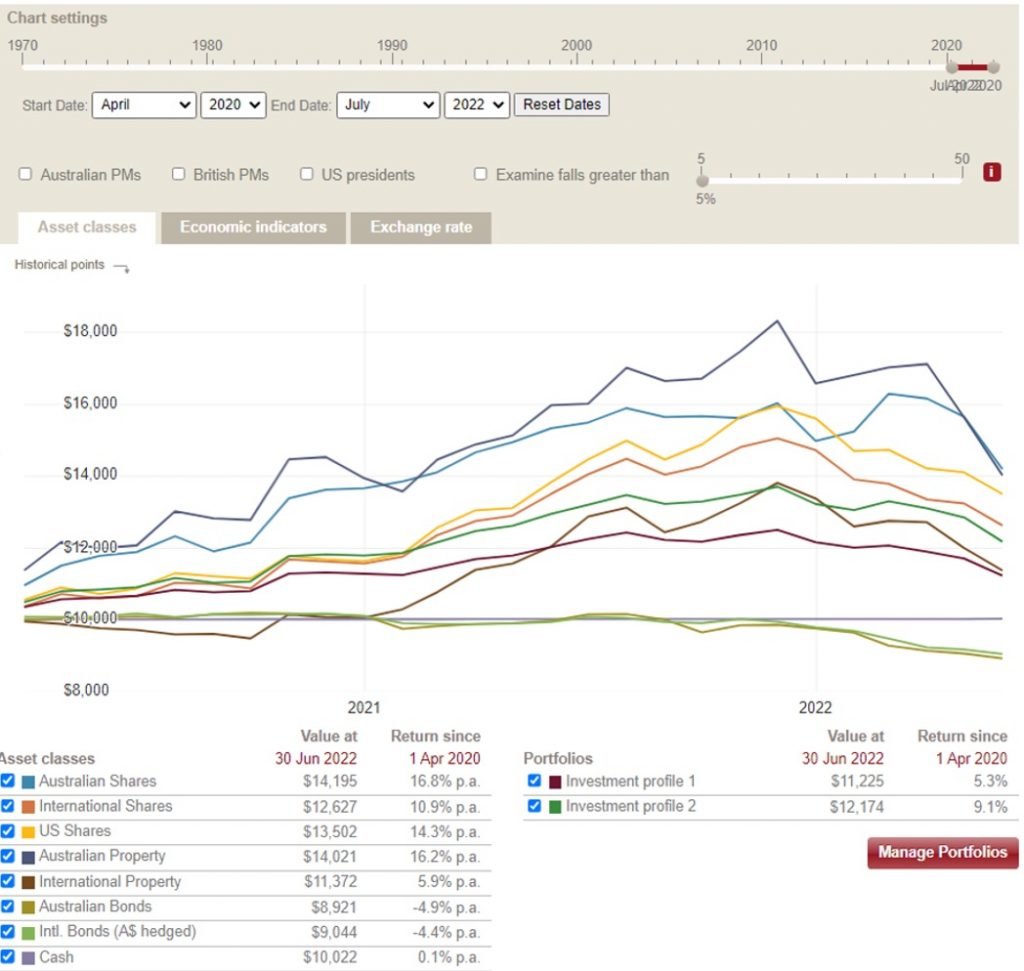

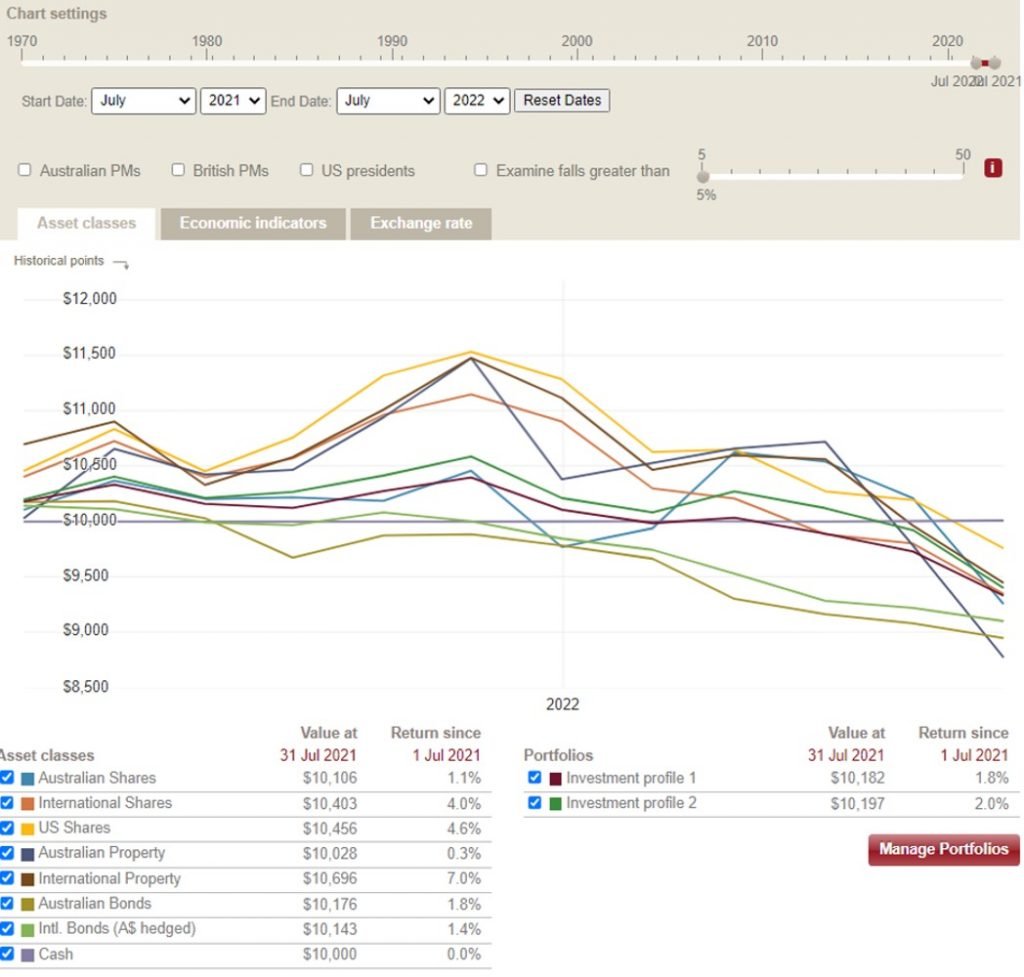

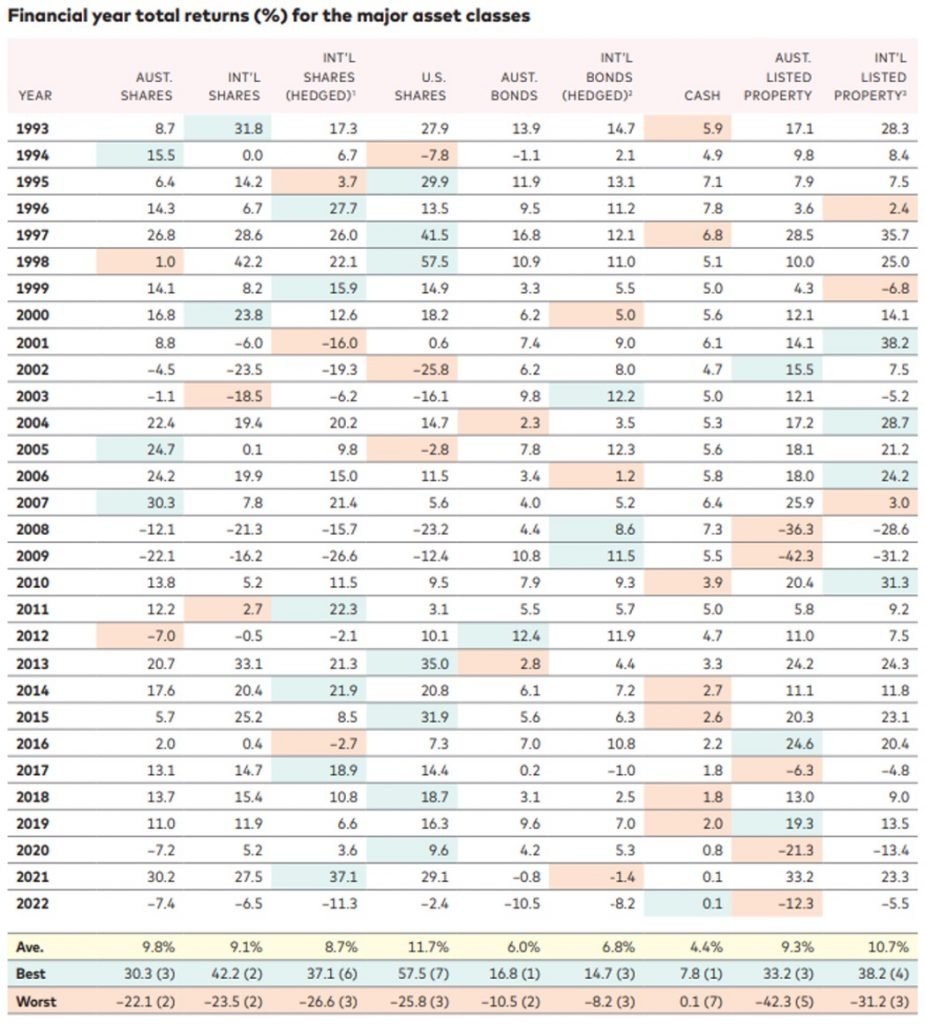

Cash return versus a balanced option, a growth option and share market returns:

Since 2010

Since Covid April 2020

Last 12 months: We are now seeing negative returns

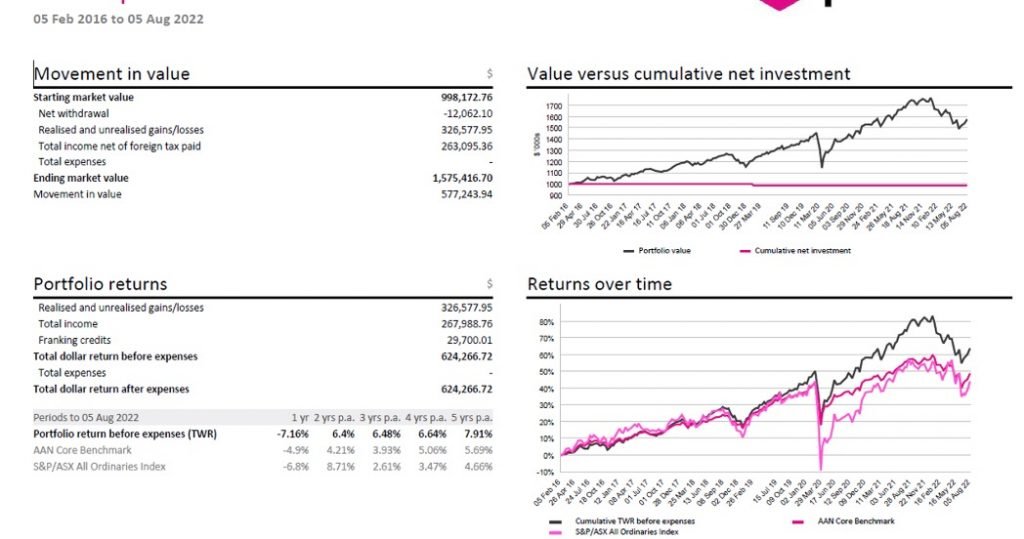

Our own client’s experience:

What are your options?

Investing in cash will be a certain low return over time but it’s also low risk – attractive to some.

Property has had a huge gain since Covid but we are starting to see the reversal of this at the moment with interest rates increasing.

A balanced approach is a middle of the road approach designed to provide some of the upside but will also provide some of the downside.

A real return or life-stage approach are becoming more popular, particularly in the industry superfund sectors. These approaches are generally looking to earn more than cash but smooth the volatility out over time. It is a trade-off between return and volatility.

Investing in equities will provide more opportunity for growth and potential dividends from Australian shares but equities also provide more volatility.

How you invest should depend on your tolerance to risk which is something your adviser will work with you on.

Can I ‘smooth out’ the volatility?

Our philosophy is that all new money invested should be invested a little bit per month over a number of months. This reduces the risk of when you enter the markets.

Take some profits. We adopt a quarterly reweighting approach for all of our clients. That is, in positive quarters we look to sell some of the better performing assets and buy some more defensive assets. Then when we have negative quarters we do the opposite; we sell the defensive assets and buy the growth assets at a discount.

A balanced approach will help smooth the return out.

We also suggest people hold 1-2 years of cash buffer at all times. This allows you to get through the negative periods in markets.

Not every investment allows it, but ideally if you can separate the income generated from the investment from the growth, this can also help smooth out any volatility over time. Think of it as spending the rent and leaving the house there…

Why do people lose money?

People will:

- try to time markets;

- agree that they will accept the potential for a negative return from time to time to get an average higher return and then as soon as there is a negative they change their mind and cash in, then wait for markets to recover and then buy back in;

- buy too much of one investment;

- invest too much into an illiquid investment;

- not accept that in markets there will be negative years.

Personal bias controls our decisions – some people become anchored on a stock or a position, others sell at the bottom and never invest again. History would show a long term approach without tinkering would have delivered a good result.

REMEMBER – it does not have to be all about shares. Most retirees prefer a balanced approach with cash buffers and some safeguards in place.

If you purchased a property for the rental income which you’re still receiving, then the current downturn in property may not be an issue.

Property Investments

These will be driven by interest rate movements and the flow of money.

We are seeing interest rate increases. This will slow buying in this area as there are then less buyers in the market. This is due to the flow of money because less people[CS1] [TT2] are prepared to borrow to buy property until they know where interest rates may peak.

Tenants have not seen issues but if the general economic conditions deteriorate then there could be some issues in that area and similar can be said for commercial property.

Property should also be seen as a long term investment. The last few years have not been normal.

2022…

So why is it different?

- For the first time in decades there is real inflation. The cost of goods is going up. This will cause some issues if there was a fixed price contract signed in advance then someone is making a loss. Someone needs to be able to cover this loss. The longer this continues, we will see companies having issues. The building industry is a great example; if they quote a job today it is based on today’s prices BUT the job they are working on was probably quoted 12-18 months ago. There is already signs inflation is decreasing[CS3] [TT4] .

- Covid and wages – There is currently a lack of people wanting full-time work. This shift in the idea of work/life balance is causing changes. My personal view is that as costs of mortgages and the cost of living increases, we will see more people with the need to be employed and hence more returning to full-time work. There is a general sadness in the world post-Covid and it is easy for people to say “no” and become comfortable with isolation and the working-from-home lifestyle.

- Interest rates were arguably left too low for too long. Now these needs to be normalised.

- [CS5] has reared it’s head and we have not seen this for decades.

- Property had an unprecedented increase in the shortest time.

- There has been a change in work habits and changes in spending.

Any Good News?

Unemployment remains low. While people have jobs they have money to spend.

The interest rate cycle increases look to be largely already implemented. There is a lot of debate around how much further they will increase but what I can tell you is that changes to date are already having the desired effect. These do take time to hit the economic numbers.

Shipping container costs have halved since January, and now we are seeing ships moving again.

This is a sign of economic activity increasing again, and this will help ease supply chain issue.

China

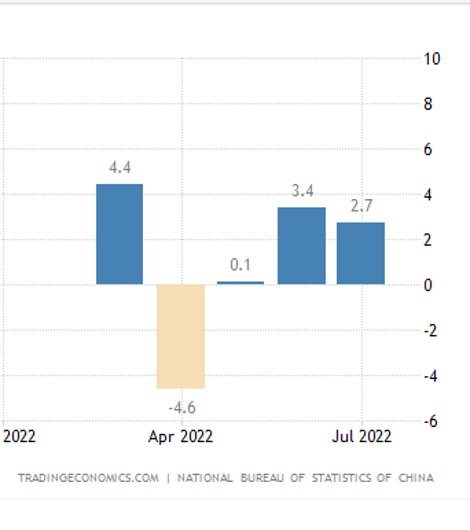

They have increased production in manufacturing for the last two months after a significant slowdown in April due to Covid lockdowns. According to the National Bureau of Statistics of China: Manufacturing Production in China increased 2.70% in July of 2022 over the same month in the previous year. See graph following:

Global air travel

According to the International Air Transport Association (IATA), total traffic in May 2022 (measured in revenue passenger kilometres or RPK’s) was up 83.1% compared to May 2021, largely driven by the strong recovery in international traffic. Global traffic is now at 68.7% of pre-crisis levels.

Summary

All markets have cycles and you have many options available to you so that you feel comfortable and can pass the “sleep test”. Some options that could be considered are:

- Remain in cash and accept a lower return but have certainty;

- Accept some risk and have a real return or life stage type investment;

- Invest in property and live off the rent and try not to sell during market downturns. You need to try and make the buying and selling decisions at the correct part of the cycle which can be difficult;

- Try and time markets and outsmart the world. This is extremely difficult!

Personally what we like to do:

- For retirees we like them to have enough cash buffer to ride through market cycles. This provides peace of mind knowing they don’t have to sell down assets that may have been subject to market volatility and showing a lower value, just to fund their income requirements. This provides time to ride out markets and let capital recover;

- We like to invest in investments that separate the income and growth components in the portfolio;

- We actively reweight the portfolios each quarter to allow the portfolio to be remained invested according to original asset allocations;

- We have an equal weighting approach to remove style bias and we limit the allocation to any single manager or asset sector. This adds to diversification within the portfolio.

Even adopting strategies like these, you will still have negative periods in investing. This is normal however it is the longer average rate of return that we are looking to deliver.

As mentioned earlier, this is not personal advice and these strategies may or may not be suitable for you, the information has been provided for general information purposes only. We would welcome the opportunity to meet with you to consider your personal situation and what’s right for you and how we can best assist in building your investment portfolio.

Ask Troy a Question.

Simply fill in the below form with your question and we will get back to you shortly.