Last month we looked at just how real the need for insurance is, so this month we thought we would have a look at the types of cover available and the current statistics surrounding claims. It’s always good to look at the facts.

There are lots of insurances available, with four of the most common being:

- Income protection (IP) insurance

- Total and permanent disability (TPD) insurance

- Life insurance

- Trauma insurance

Which insurances are right for you? To help you answer that question, here’s a quick summary of those four insurances:

IP insurance

Income protection insurance pays up to 90% of your pre-tax income if you’re temporarily unable to work due to a disability caused by illness or injury. IP insurance may be suitable if you have a mortgage, have dependents or have minimal savings.

TPD insurance

Total and permanent disability insurance pays out a lump sum if you’re permanently unable to work due to a disability caused by illness or injury. TPD insurance may be suitable if your current savings would be unable to support yourself and your dependents for the rest of your life.

Life insurance

Life insurance, also known as death cover, pays out a lump sum to your nominated beneficiaries (typically family members) when you die. Life insurance may be suitable if your beneficiaries would struggle to support themselves when you pass.

Trauma insurance

Trauma insurance pays out a lump sum if you suffer a serious illness or injury. Trauma insurance may be suitable if your current savings would be unable to cover any large, and potentially ongoing, medical and rehabilitation bills.

Cancers, dementia and heart disease

When it comes to serious medical conditions, the data can make for unpleasant reading:

- 1 in 5 men will develop prostate cancer in their lifetime

- 1 in 7 women will develop breast cancer in their lifetime

- 1 in 12 Australians aged 65 years and over are living with dementia

- 1 in 14 Australians will develop melanoma skin cancer in their lifetime

- About 19,000 Australians die of coronary heart disease each year

According to the most recent data from the Council of Australian Life Insurers (CALI), during the 2022 calendar year, about 85,000 Australians received claims for income protection, TPD, death and other types of cover (including trauma). Insurers paid 95% of finalised claims.

CALI also notes that “6% of the population are over-insured but the majority are underinsured to meet basic needs”. CALI adds: “1.0 million Australians are underinsured to meet basic needs for death / TPD and 3.4 million are underinsured to meet basic needs for IP.”

With few exceptions, a good financial plan involves taking out a range of insurance policies to protect you and your family, so it’s alarming to see so many people are underinsured.

Insurance can be a lifesaver

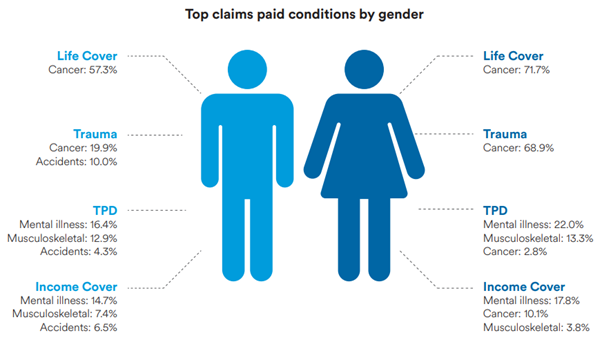

Metlife has some informative claims data, which shows the most common conditions for the different types of insurance. All the conditions listed below are extremely expensive to treat, which is why insurance can be – literally – a lifesaver.

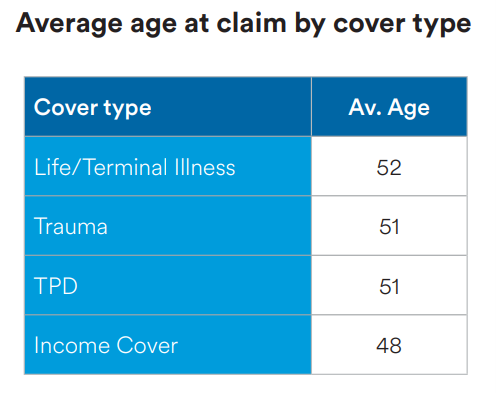

Other Metlife data show that the average age at which people make insurance claims is surprisingly young, reinforcing the case for middle-aged and even younger people to protect themselves.

The good side and bad side of insurance

At RFS Advice, we often see the good side of insurance – clients receiving large payouts at vulnerable moments in their life. Unfortunately, though, we also see the bad side – clients suffering severe financial and emotional stress because an unexpected incident occurred and they weren’t adequately insured.

We know, from bitter experience, that anyone who’s underinsured is taking a grave risk. So we are, unashamedly, major advocates of insurance.

There’s no one right insurance package – the type of insurances you should get and the amount of cover you should secure depend on your unique circumstances. Insurance is complicated, so rather than trying to figure it out on your own, we strongly recommend you talk with the RFS Advice team.