There are a number of ways you can fund your retirement but you only need a plan that works for you and your household.

Each household is different. Some people want to leave everything to the kids others believe in the “SKI” theory: Spend the Kids Inheritance!

What is important is that you make a conscious choice rather than letting life simply take its course.

Some people like to go out to dinners, for others it is coffee.

Some it is golf or bowls or the newly popular pickle ball.

We live in a beautiful part of the world and there is a lot of beaches, bush walks bike ways that are all free for us to enjoy.

While the costs of everything seems to be going up a few changes to the routine could help combat this.

What is your thought of retirement incomes? Are you happy to draw down the money as it was for your retirement, or do you want to maintain this for the kids? This issue will be a large debate in future years as property prices have gone up so much.

Helping the kids or grandchildren enough without it being too much seems to be the key. Not too much that they do not appreciate it and enough that what you do for one you can do for all.

So many questions, decisions and considerations. So where to you start?

How are retirees funding their retirement?

The following examples include many different ways that retirement income can be derived from:

- Full or part age pension

- Volunteering and accessing job seeker from age 60-67

This can work well as it can allow your super to grow until retirement age. It stops you drawing so much out of your super in the early years.

Self funded via a allocated pension or investment

You may have investments or a significant amount in superannuation. Ideally you want to have a focus on income producing with some capital growth over time.

Part Time Work

We are finding a lot of people doing part time work and most of the time it is not in what they did in their working life. It is something they enjoy or the social interaction. This helps to reduce the drawdown on your super in the early years of retirement.

Residential Rental properties

This can provide income and some capital growth over time. We are finding a lot of retirees are not getting enough income out of the properties with the cost of everything increasing. Some are finding that the running costs are eating into their incomes.

Commercial Rental properties

These have seen a large increase in value as the coast expands there has been an increase in demand for commercial properties that are in the middle of town.

Family Business

We really enjoy helping clients transition the family business over to the next generation. This can provide an ongoing legacy. It can provide an ongoing income throughout retirement for the parents and the kids can then take over the business.

Air BnB

This has been popular for a while now. Some are doing this with their second property as it produces more than long term rentals. Others have their house set up to provide this additional income from their home. This does not appeal to everyone.

Selling out of the Unit with high Body Corporate fees

We are seeing this as a growing issue.We are seeing clients sell out of units in high rise buildings with large body corp fees and move into duplexes or small free standing homes.

Passion projects that make you money

We have seen some clients selling their hats and even lamps online or at markets. This can satisfy your creative needs if you’re that way inclined as well as provide some additional income.

UBER or taxi Driving

The Uber option in particular allows you the freedom to clock on and off as you please and provide that additional income. You also meet a lot of people in the day so it can have a good social component as well.

Part time teaching

This is more specifically to teachers that no longer want a full-time job but can generate enough to live by doing relief or contract work.

- Baby sitting, Dog Walking /sitting

- Handyman or gardening work to stay active and healthy.

- Not Retiring.

- Boarders or move the kids back in to pay some rent.

How Much super do you need?

A good starting point here is ASIC’s Money Smart website. Here is a link to their page: How much super do I need?

This website is able to help you calculate what your potential superannuation benefit may be at retirement and then whether this amount will be sufficient to help fund your desired retirement income.

Another good guide is the AFSA Retirement Standard. How does your retirement income figure compare to the following:

On the coast we have seen incomes around $50,000 to have a reasonably lifestyle. There is no doubt the cost of living has put pressure on this number over the last few years including the cost of travel.

Travel costs are back and this is great news and a great thing to factor into your retirement budget. Post Covid it is great to see people getting out there and seeing the world again.

Rule of 6%

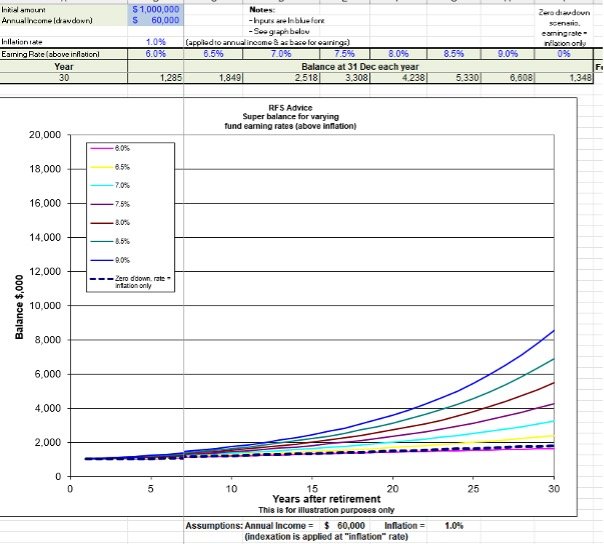

A lot of people overestimate how much income they will actually need in retirement. For example purposes we use around a 6% drawdown and a 6% earning rate. The simple rule to stick by is that if you draw 6% of the capital value each year you should be able to maintain or growth your balance under a balanced style approach. See an example as follows:

Balance 6% Draw

$500,000 $30,000

$1,000,000 $60,000

$1,500,000 $90,000

$2,000,000 $120,000

Over $2 Million lets set some goals.

What problems do we see?

There are number of different things that can go wrong with retirement income. Some of these are:

- People overestimate the returns from their investments

- People do not take into account market conditions

- You need to consider cashflow management and bucketing strategies as there will be negative markets

- Chances are there will be health events and costs to deal with

- You need to adjust your risk profile in retirement as compared to your working life

- People spend too much helping the kids to their own detriment over time

- You become the baby sitter and never get to go on that dream trip

- People waste money on the constant new toys

How Advice Helps:

The advantages of seeking financial advice pre and post retirement can have huge implications on your financial future when considering things such as how much income do you , where I get the income from and how long will my funds last?

A good financial adviser will help you set realistic income goals based on your actual financial position. This may include setting up bucketing strategies to ensure you can get through market volatility.

At RFS advice we actually want our retirees to benefit from market volatility by having strategic quarterly rebalancing for all of our clients. This means taking profit and rebalancing your portfolio back to it it’s original investment allocation to ensure that you are remaining invested according to your risk profile.

Yes, there are fees involved with seeking advice. A minimum ongoing relationship with an advice firm now would cost around $3,300 ongoing per annum. The costs of professional advice have gone up but so has the educational standard of the profession. Some higher net worth clients could be paying as much as $50,000 per annum and they see value at that level. It is interesting given that those with larger balances are paying a lot more and they are more likely to seek advice.

Industry super funds are trying to help people that do not want to pay for advice or want to do this themselves. They are there to help that sector of the community.

The great thing about Australia is that you can seek personal advice and be as involved as you like. You can be a Do-it-Yourself investor or you can go with a low cost online solution. We are seeing larger providers of low-cost index options enter the Australian market do deal with consumers directly online.

What do we do at RFS Advice: We offer personal specific advice.

We have a team approach so there is always two people in the meeting, so you have multiple points of contact that know your exact position at all times.

We have the retirement team that specialise and work with all different retirees situations, for example, those that are self-funded or those that are part self-funded and part age pension. This team specialise in helping people maximise their entitlements and retirement income.

We have a team that look after the business clients and higher net worth individuals that are still in the wealth creation phase.

My team is the High-Net-Worth team and there will be two qualified advisers in your meetings. This provides a much broader offering and potential for ideas generation.

The Aged Care advice team help when people need advice on Aged care. This could be something you are thinking about yourself or sometimes it is the Powers of Attorney as someone has had a visit to hospital and cannot return home to independent living.

Summary

If you haven’t already thought about your retirement income then now is the time to start planning. Perhaps you’re close to retirement or perhaps you are in retirement and feel that your current position is not working and a review could be worthwhile.

We are here to help and would encourage all Australians, regardless of their asset level, to seek advice for their own personal situation to maximise their retirement position.

If you’re in Pre Retirement, you may be a business client or you have a higher income and want to maximise your current income, then we have a team that can work with you. Our team will assist with setting realistic goals and then help you achieve them.

If you’re in retirement then consider, do I have my assets set up appropriately to help maximise my income and/or any government entitlements. What do I need to change? How do I make my capital work better for me?

If you’re a High Net Worth Individual, whether that’s pre or post-retirement, this will be a different, higher touch service model that would your suit your situation and needs better. We have a highly qualified, personable team that is ready to help with maximising your financial future.

Aged Care: It could be self-directed or an unfortunate health event that creates a need with a Power of Attorney. Our qualified, compassionate team is dealing with this every day and understands the challenges and complexities of what can be a difficult time.

It doesn’t matter what stage of life you’re at, at RFS Advice we are here to help.

Ask Troy a Question.

Simply fill in the below form with your question and we will get back to you shortly.