Apologies for the hiatus in these commentaries. I was practising what we preach by taking an extended break in Europe.

Troy and I joined forces some twelve years ago in March 2011, so it was time to give him a well-earned break from me! He and the team have assured me I was missed but the place seems to have functioned very well without the CEO, so I am not so sure…?

The good investment news is that 22_23 was a far better financial year than 21_22.

The 2021 financial year (FY) started well but we ran into the Ukraine-Russian conflict on 24th February 2022 and that brought a range of underlying structural problems very much into the limelight.

Scroll forward some seventeen months and those impacts are still being felt, especially in Europe. Not just the dreadful human toll but also the reconfiguration of both geopolitical and energy security on that continent.

The start of the 22_23 FY saw inflation really start to take hold and the central banks dramatically increasing interest rates from their record lows.

Xi Jinping had just organized his next 5-year term, property companies were failing around the world and there really wasn’t a lot of good news anywhere.

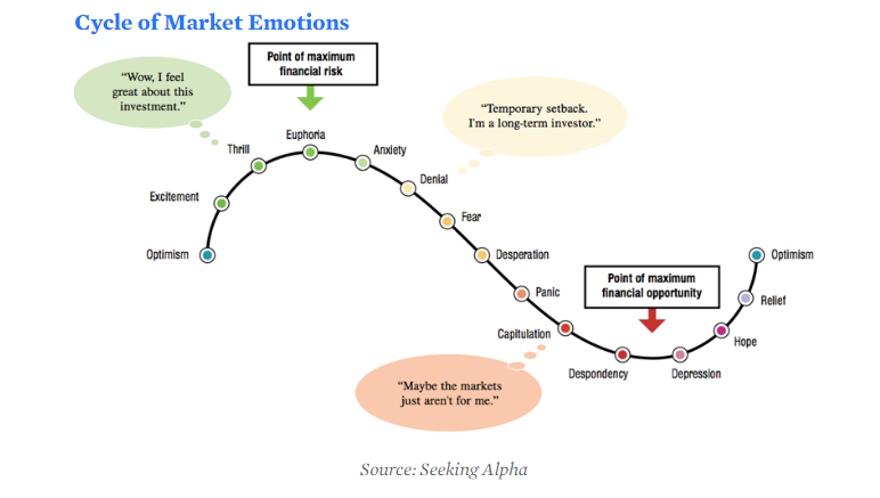

Back in October 2022 I wrote about ‘the cycle of market emotions and the tendency we all have to give in to despondency and the bad news that seems to be a constant.

rfsadvice are-we-ready-to-capitulate

This talked to the market returns for 1 Oct 2021 to 30 Sep 2022. They really were not pretty, and I presented the below as an example of how we can react to these sort of market conditions.

After what was a very difficult time in markets, from 21 Oct 22 to 20 July 23 we then saw:

- Australian All Ordinaries : 8.6%

- US S&P 500 : 20.8%

- Australian Property Securities : 11.0%

Over the twelve months 1 July 2022 to 30 June 23, performances of various indices were:

- Australian All Ordinaries : 14.32%

- US S&P 500 : 19.24%

- Australian Property Securities : 7.29%

In the twelve months to 30 June 2023 our primary models had returns of:

- AAN Core : 11.44%

- AAN Growth : 15.88%

To put that in perspective, some other investment alternatives in the balanced space for the year to 30 June 2023 achieved:

- Q Super Balanced : 3.98%

- Australian Retirement Trust (Balanced Fund) : 10.0%

- Hesta Balanced/Growth : 9.5%

- Australian Super Balanced : 8.2%

Returns can move around so we aren’t getting ahead of ourselves here, but very happy to see that sort of recovery in many of our clients’ portfolios.

So, what about 23_24 and beyond?

Coming into 23_24 there is still have an amount of uncertainty but the strength we have seen from markets is most likely the unwinding of inflation.

The US has seen inflation numbers drift back to 3.1% and there is an argument to say they are about six months in front of us.

Australia?

The Australian CPI number for the June Quarter. 2023 was 0.8% which extrapolates to 3.2% for the coming year. The total CPI for the 22_23 year was 6.0%. (That is the accumulation of the four quarters in the 22_23 FY).

We are by no means out of the woods as a few of the government’s changes have now started:

- 15% pay rises for all aged care workers, funded by the Australian taxpayer for 4 years. This is only for government funded aged care facilities, so private facilities will need to manage this increase in costs by increasing the costs to consumers. A good example of government policy that warps the sector.

- This funding by the taxpayer for only government facilities has contributed to closures all over Australia but particularly in the regions.

- All aged care facilities are dealing with staff shortages, but workers are going to be attracted to public facilities.

- The government also mandated all aged care facilities would have qualified nurses 24/7 from 1 July 2023 which effectively means at least 3 fully qualified nurses to cover a 24-hour shift. The numbers didn’t remotely stack up here as we already have a nurse shortage, but this has added to regional closures as the regions simply don’t have access to multiple nurses.

- Building costs for the 23FY were up by over 44% in some states including Queensland. Some of this is supply chains that should soften as we re-establish normal trade, but private industry is also battling with state and federal government projects in competition for trades and supplies. As per the aged care wage increases, the taxpayer is funding this competition. The private sector would argue our federal and state governments are offering higher wages than the private sector can afford which then pushes up the costs of building for the Australian consumer.

- Green tape is also reducing our access to domestic timber, so we are more heavily reliant on imported goods.

- Green tape is slowing new projects which is putting pressure on housing availability and increasingly, affordability.

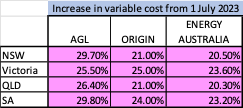

- Energy costs for most Australian consumers just went up by between 20% and 29.8%:

- The biggest impacts are on businesses and residents in higher density living like units as they cannot offset the costs using tools such as solar.

- The governments new Industrial Relations reforms are calling for same job, same pay which sounds reasonable (this is the model used in the Soviet Union and North Korean), until you consider qualifications and experience. A 2nd year nurse verses a 20-year equivalent, should not be paid the same amount.

- The unions are also demanding contracted and part time workers be offered full time work and benefits which impact a whole range of industries from retail, restaurants, transport and shared service models like UBER.

If this is pushed through by the government and cross benches, it is likely to translate into increased costs for the Australian consumer as well.

- Lastly, immigration is back and the forecast for last year, 22_23 was for 400,000. 23_24 is forecast to be a more moderate 260,000. This will also put pressure on housing and pretty much everything but hopefully eases staff shortages.

These are just some of the impacts that will play into the inflation genie this year so we might be coming out of the Covid induced inflationary period but walking straight into a whole new version.

How will this play out in investment markets?

The bad news above is likely to be largely factored into Australian share market pricing which performed relatively well in 22_23.

- There will of course be some great opportunities, but the mining and agricultural export solutions may stagnate as new projects are quashed and our farmers deal with escalating costs and red, green and now as WA is finding out, indigenous tape.

- Companies supported by the governments push to renewables will see substantial revenue growth and we have an emerging tech and health sector.

- Education is returning as a major export as Chinese students return to the market. In January this year the ‘Chinese Service Centre for Scholarly Exchange’ announced “academic degrees and diplomas would no longer be recognised if study was taken online”. This means some 700,000 Chinese students are looking for a home and around 150,000 would have already been enrolled in Australia’s online courses.

- Tourism is certainly returning though we are an expensive destination at the moment, as flights are very expensive and limited – well below pre-pandemic numbers. There are airlines wanting to increase flights to Australia like Qatar Air, but these are currently being blocked.

- Ironically Qantas is arguing protection of Australian jobs, but our airports would love to see more flights and could then appoint more staff. However, there is the problem of where they will find them? Maybe in those 260,000 new immigrants?

The rest of the world?

Geopolitical issues aside, the world is recovering.

The big outlier is debt but, reduced abilities for governments to spend may actually provide increased opportunities for traditional investments and the private sector.

When it comes to federal government debt, Australia is a long way down the list of problem countries.

At December 2022, of some 166 countries in terms of debt to GDP, we rank 137th (36.1%) with 166 being the lowest (Brunei at 1.9%).

- Japan is a clear winner at 262%, even knocking off Venezuela at 241%. Greece (193%), Sudan (182%) and Lebanon (172%) round out the top 5.

- Interestingly Singapore is 7th (160%), Italy 9th (151%) and the United States is 11th at 129%. France is 19th at 113% and the UK is 24 at 97.4%. People’s Republic of China is 51st at 76.9%.

The United States has eyewatering debt.

- The Federal Government accounts for almost $33 trillion dollars of their debt but they are also a big economy.

- Federal tax receipts are approx. $4.5 trillion dollars.

- Unfortunately, the federal expense budget is $6.4 trillion dollars. The annual deficit is $1.5trilion.

A trillion is a lot. One trillion is 1,000,000,000,000.

That should make you feel better about Australia?

With softening inflation and domestically driven economies returning to a new normal, there can be a lot of opportunity.

- Interest rates look to be flattening and that will be provide more certainty for investment.

- Cashed up businesses will take advantage of cash strapped businesses and quality businesses will do well.

There will be ongoing volatility and any move down in interest rates will indicate that recessionary winds are in play.

Our focus continues to be quality investments and quality investment managers and that doesn’t change.

As always if you have any questions or concerns, please do not hesitate to contact us.

Paul Forbes, RFS Advice CEO