You could be forgiven for thinking Australia is in dire straits based on the ‘news’ reporting and I do have fears that our media is promoting the same partisan rubbish we saw play out in the Biden/Trump election.

Instead of reporting, it seems that individuals’ opinions in the media are the only thing that matters.

In the last two years, Australia has done remarkably well.

Vaccines:

Shutting our international borders removed 99% of the Covid19 threat and federal funding for the most damaged industries mitigated some of the losses that decision incurred.

The strategy was always to wait it out and hope for a vaccine which would then allow us to protect our community and reopen with as little illness and loss of life as possible.

By December 2020 we saw the first vaccines released to market and then we watched as countries, with far more significant health concerns than ours, took those solutions out to their populations.

I know the media and opposition parties like to throw around Scott Morrison’s statement that “it was not a race” (taken slightly out of context), but I would argue it wasn’t.

In business, we talk about ‘early adopters’ and ‘smart followers’. Early adopters take the risks and the smart followers look at the results and get to choose a proven solution. When it comes to human life, I think smart following could be considered a prudent option.

Australia has not just caught up but is now one of the most vaccinated countries in the world (https://ourworldindata.org/covid-vaccinations ).

The data for 21 November 2021 is 53.2% of the world population has received at least one vaccine dose. 7.69 billion doses have been administered and 26.88 million doses are going into arms every day. (The Australian population is approximately 25.9 million. There are more doses being administered internationally DAILY than our population).

At 85.1% of our eligible population double vaxxed and 91.5% having had their first dose we are in the world leaders. The link above is based on total population as some countries include children under 16 but the numbers that are important to us are the ‘eligible’.

On total population the UK, France, Germany, and United states all have lower vaccination rates than Australia, despite the head start we gave them.

The Australian Economy

In July 2020, we were forecast to have a federal government deficit of $185 billion for the 20_21 Financial Year (FY). We were almost ‘back in black’ for the 19_20 FY but the pandemic response meant that forecast faded very rapidly from March to 30 June 2020.

The actual deficit for 20_21 was $134.2 billion: $50.8 billion less than forecast but still huge. The 21_22 budget deficit was $106.6 which, while high, is only $26 billion above the 2016_17 deficit so back in the manageable space and unlike escalating state budget deficits, this isn’t public servant salary spending. This is largely financial stimulus and middle class welfare for working parents.

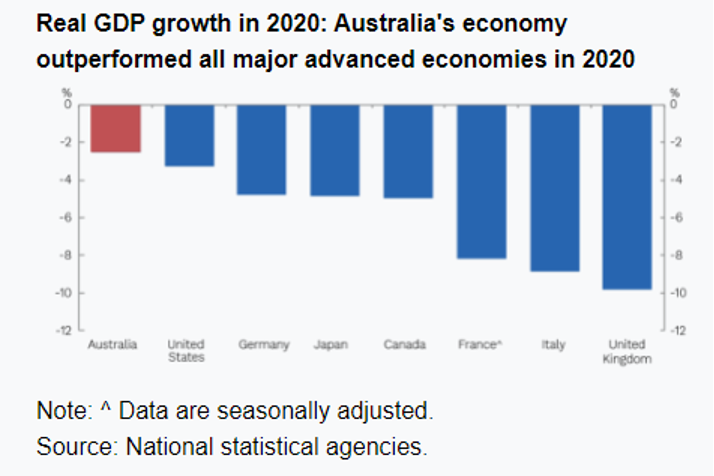

Our underlying Gross Domestic Product result was also very commendable when compared with our peer group. Not surprisingly a negative for the 2020 FY (-2.1%) but then a positive 1.4% growth in the 2021 FY.

Unemployment: ( ABS Job Statistics Aus)

The renewed lockdowns in Victoria and New South Wales blunted the great growth we had seen but we are almost back to pre-pandemic employment numbers and likely to get there in January 2022. There are not many businesses without a help wanted sign on the front door so there are opportunities for those looking for them. Many restaurants are not back to their pre-pandemic trading hours and some of that delay has been caused by lack of availability of staff.

There were 25.5% less unemployed people in October 2021 compared to October 2020. Those people are contributing to the economy which has flow on effects everywhere.

With limited overseas immigration, Australia could easily see unemployment numbers as low as 2008, which were at 4.1%.

Agriculture ( Agriculture-set-for-record-70-billion-year )

The recent flooding will have some negative impacts on crops but Australia’s farmers generally had a great 2021 after a very good 2020. Despite mice plagues, radical elements and our ever-changing weather patterns, our famers have been able to bank some good years which will help them through 2022 and beyond.

In the September numbers, crop production was set to rise by 7%, with another near record year of winter crop harvest and demand for our grain, sugar and cotton has been helped by strong global prices.

For those worried about our barley growers, after the Chinese Communist Party (CCP) banned them to try to punish Australia for having the temerity to question Covid 19’s origins, they have quickly found new markets, as all it did was change who was supplying who. Australian barley producers are now supplying South America and the Middle East.

Livestock production is also forecast to be up by 8%.

Iron ore prices have dropped but that was coming off unsustainable highs and the Federal Budget only forecast a price of $55 a tonne back in May 2021 and it is still at $94 (24 Nov 2021). Twiggy (Andrew Forrest – Fortescue) mightn’t be making as much money as he was but I think he and Gina Rinehart (Hancock Prospecting) are still doing okay.

Despite Boris Johnson announcing the death of coal, our exports have never been higher. China is seeing energy problems and despite being the largest coal mining country in the world, it needs imports to fire its 1,000 coal fired power stations and the 100 stations it is currently building.

The largest producers of coal after China are the United States, India and then Australia in that order.

Australia is the second largest exporter of coal, after Indonesia but the fourth largest producer and the quality and efficiency of our thermal coal keeps our coal exports very much in demand. Australia only has 24 coal fired power stations domestically, but those stations still supply 80% of our electricity power needs.

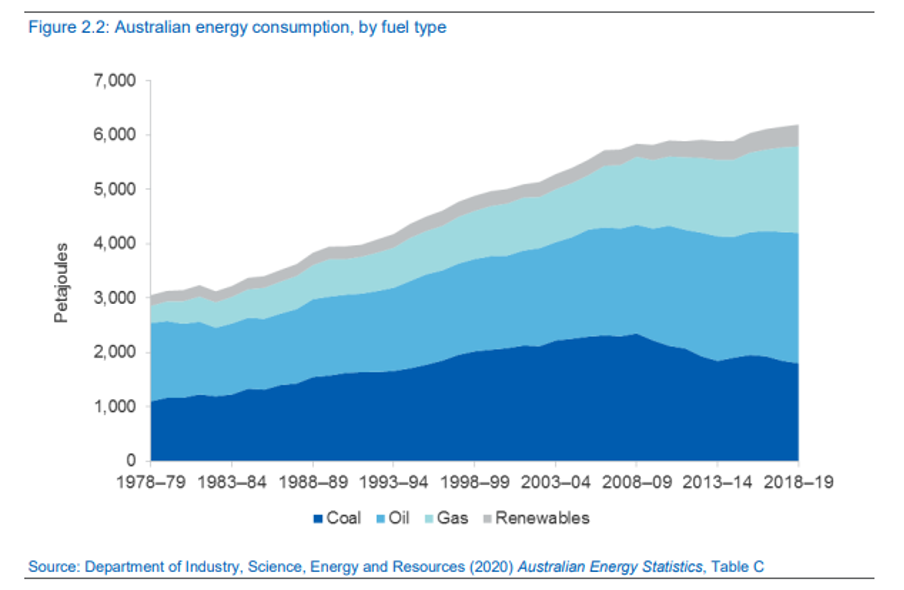

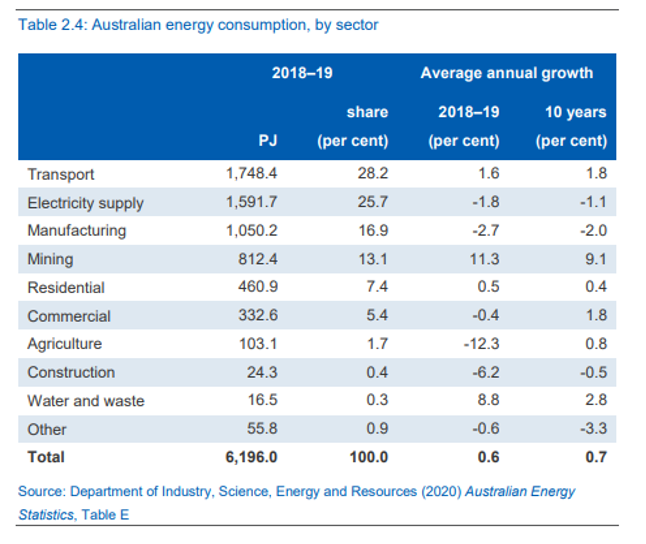

Interesting side note, as that 80% number seems high, given Australia is the highest adopter of domestic solar in the world. This is only electricity production. If we look at our total energy mix including fuel – oil, Natural gas and renewables, coal is 29.1% of energy consumption. Oil is higher at 38.8%. Australian Energy Statistics

If you then look at sectors and who is using this energy you can see that our residential consumption is only 7.4% of the total annual energy use. Solar helps but there is a bigger picture.

Mining exports account for 69% of our total exports at the moment. Obviously tourism and education are well down and should recover in coming years but mining is a huge part of our domestic economy and will be for the foreseeable future.

Based on 2016 coal consumption – the latest coal reserve numbers we have – Australia already has proven reserves of 1,231 years of coal left (https://www.worldometers.info/coal/australia-coal ). Natural gas reserves are only at approximately 44 years.

Building and property prices

I don’t know anyone who doesn’t have a story about a house in their neighbourhood going for a ridiculous price. Prices have gone through the roof and building supply costs have also jumped alarmingly. We have many clients who have used this bubble to crystallise gains and they have done very well.

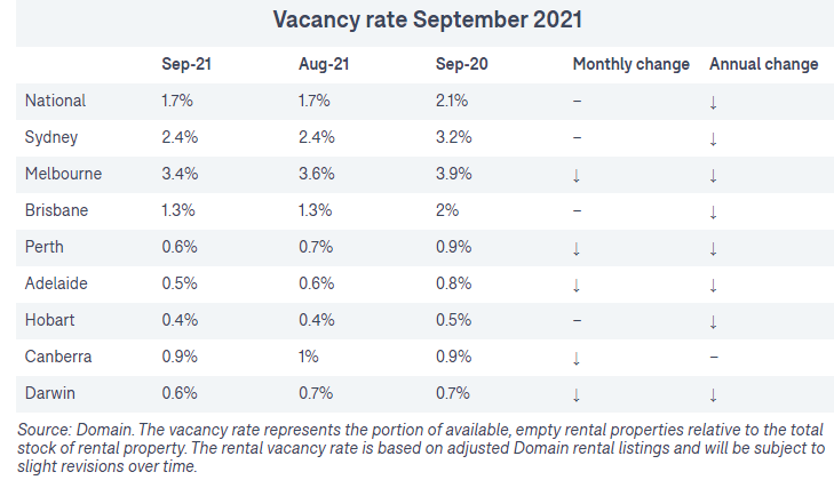

The building supply issue will eventually soften as supply chains around the world improve and there is an argument that property prices will then ease. The forecast below has property prices dropping in 2022. There is a counter argument that availability is already stretched and rental vacancies are at a low (see second graph below). With potentially 200,000 immigrants moving to Australia in 2022 and 2023, the real answer is probably somewhere in between.

There is unlikely to be a softening of prices while supply is so low but in the medium term, it can be argued that price growth has been brought forward by 4 to 5 years. Prices may stabilise and maintain at these levels but affordability is the limiter. Wages growth is still very low and this is a good leading indicator – in normal times.

So as we finish 2021, Australians can be pretty happy with how we are travelling. Yes, we have border frustrations and vaccine mandate issues as well as continuing tough times for our tourism industry and all the ancillary businesses that support it, but you can see 2022 improving.

I would echo Scott Morrison’s line from last week, that I think we have all had enough of state and federal governments controlling our freedoms and media trying to scare us into submission.

Time to open up and let everyone in Australia enjoy a family Christmas no matter what state you live in and then be ready to open to the world in the New Year.

It has been a very interesting 20 months and very challenging. Time to move on and celebrate what we achieved together.