No matter what side of politics you sit on, you can appreciate the enthusiasm of the ALP after finally winning an election after 9 years.

Mr Albanese is understandably jubilant and frankly, so he should be. Becoming Prime Minister of your country is no small achievement – there has only been 30 Prime Minsters before him and that is very elite company.

The other good news is that it looks like the ALP will achieve majority in the lower house by themselves. This allows them to facilitate their agenda without having to cut deals with crossbenchers or minor parties.

- For the independents in the lower house it means they may have little to no power. Mr Holmes a Court and his fund raisers may have spent millions trying to influence future policy but he, like Clive Palmer before him, may have to sit on the sidelines and watch the ALP drive their policy program without the need for negotiation.

- Greens will be a similar position even having increased their lower house representation to a possible 4 or 5 seats.

- Total seats are 150 of which ALP should hold 76-77 and LNP will have 59-60.

Arguably, this is a good result as the last half of the Rudd/Gillard years were governed with a minority and that led to frustration across the board. The LNP had similar issues in this last electoral cycle.

The senate is yet to be finalised but the Greens will have the balance of power.

That only matters if the policies proposed by the ALP are not accepted by the LNP. Given the policies taken to this election were pretty similar on both sides, it would seem likely most would not need negotiation with the Greens and there are independents like Jacqui Lambie, Tammy Tyrell (Lambie Party), possibly Pauline Hanson and Jennifer Game (One Nation) and David Pocock (Canberra)

There are 76 senatorial seats and as the ALP actually polled pretty badly on their primary vote: 32.5%, they are unlikely to increase their current 26 seats. You need 39 votes to get legislation through the upper house so the Greens, (possibly 12 seats) will help, but you still need one more. The LNP is likely to still hold 31 Senate seats as its primary vote was closer to 36% – still very underwhelming. At 31 seats they would need to convince 8 non ALP senators to vote with them to block a bill and that will be difficult. The ALP doesn’t allow its senators to cross the floor so they guarantee their 26 votes.

The ALP had a slightly more aggressive budget but both parties have been fairly generous so an additional $8.1bill of debt is not going to be a game breaker. We will be relying on Jim Chalmers (Australia’s new treasurer) to manage this as Mr Albanese was less than exciting on his understanding of fiscal or microeconomic policy during the campaign. Chalmers certainly seems capable and his management should settle market concerns.

The economic environment is changing and there are challenges

The ALP comes into government during a difficult time and yes with forward estimates we could have a Gross Federal Government debt of $960Bill by 30 June 2022 (45.1% of GDP). This will likely be revised down as our fossil fuel exports (Iron ore and Coal) have gone through the roof and royalties are way in front of expectations.

A couple of points on perspective.

Yes in the Howard/Costello years we saw Federal Government debt reduce to zero and then the GFC saw a spending spree by first Kevin Rudd and Julia Gillard and then further into the Abbott/Turnbull era. Covid then sent microeconomic policy out the window and the government spent literally billions getting us through the pandemic.

- To get to zero, Howard and Costello sold ‘stuff’; Telstra, infrastructure etc. They ran balanced budgets but that would have struggled to pay the debt down. You need assets to sell to pay off debt.

- Governments do build assets – think Snowy Mountain river scheme etc. and yes at some time you might see them offered to private hands.

- Net Government debt is forecast to be $729Bill* (34.2% of GDP) as at 30 June 2022. Net debt is liabilities minus assets.

- If you compare Australian debt to GDP ratios to most westernised countries we are still very healthy but we need to get back to fiscal responsibility…. at some stage.

- Additionally Government revenue has increased though I think the forecasts to 2024-25 in the attached link are way too aggressive (a lot of things would need to go right to achieve these numbers). If the revenue forecasts are correct, it would make servicing the debt manageable as the increasing interest payments are more than offset by increased revenue.

Pull it back to your household. GDP (Gross Domestic Product) is your household revenue. If you can see your business or income growing rapidly then as long as interest payments grow at a lower rate than your income, your ability to service them improves.

The problem would be if your income stayed the same or dropped and your interest payments continued to grow.

The link below gives you all the data from the Australian Government website

Should we run balanced budgets yet?

So if we start seeing some fiscal constraint then we can get back to balanced budgets and then we can look to sell assets to reduce this debt. (Hopefully that doesn’t include selling any more strategically important Ports to the Chinese government- like Darwin?)

The caveat is that no matter who was coming into government, slamming the fiscal brakes on would potentially be problematic. We are definitely in a slowing economy.

Inflation is baked in.

For the first time in a very long time, inflation is on the rise. As mentioned in our last update, it is overstated by supply chain issues, flood damaged groceries and the European conflict and energy crisis, but we can expect it to be in the range of 2-3% even without those transitory issues.

If we have inflation, we have rising interest rates and that puts pressure on household spending. This was discussed in our recent blog https://rfsadvice.staging-sites.com.au/well-this-is-unpleasant/

Cost of goods are inflated and consumers defer purchases. Retailers lose earnings, employment drops and yes you can have a recession. Even if we don’t have an official recession (two negative quarters) it might certainly feel like it.

Geopolitical concerns for the ALP.

The Chinese Communist Party is flexing its economic muscle in the South Pacific and this has real risks to supply chains in Australia. We are an island that manufactures very little so are very reliant on imports.

The pandemic showed us how quickly essential supplies can be disrupted and the incoming government will need to consider bringing manufacturing home.

An example that should cause concern is that we are very reliant on India for pharmaceuticals. Many people take prescriptions every day to deal with an array of life threatening illnesses. A disruption to pharmaceutical supplies through a blockade of some form in the Pacific can very quickly lead to some pretty dangerous consequences.

The Albanese government has already flagged that they will stay strong on not accepting Chinese economic coercion but there are question marks over whether throwing more foreign aid to our Pacific neighbours will actually achieve a positive result.

Australia already provides more than three times the aid to the Solomon’s than China so why would more money have made a difference. The problem with our aid is that we make the Solomon Islands government account for where they are spending our aid. Let’s just say the Chinese government aid may face less scrutiny. Our aid might work for the country but there has been an inference that Chinese aid might be more beneficial for members of the government.

Pacific concerns are not driven by climate change.

Simple facts about China and Australia

Australia is 1.3% of global emissions. If we include everything we export you can round that number up to around 5%. China is somewhere between 30-40% of global emissions and is increasing its emissions by more than 1.3% every year. If Australia stopped all fossil fuel use, starting tomorrow, within twelve months China would have replaced any saving the world made.

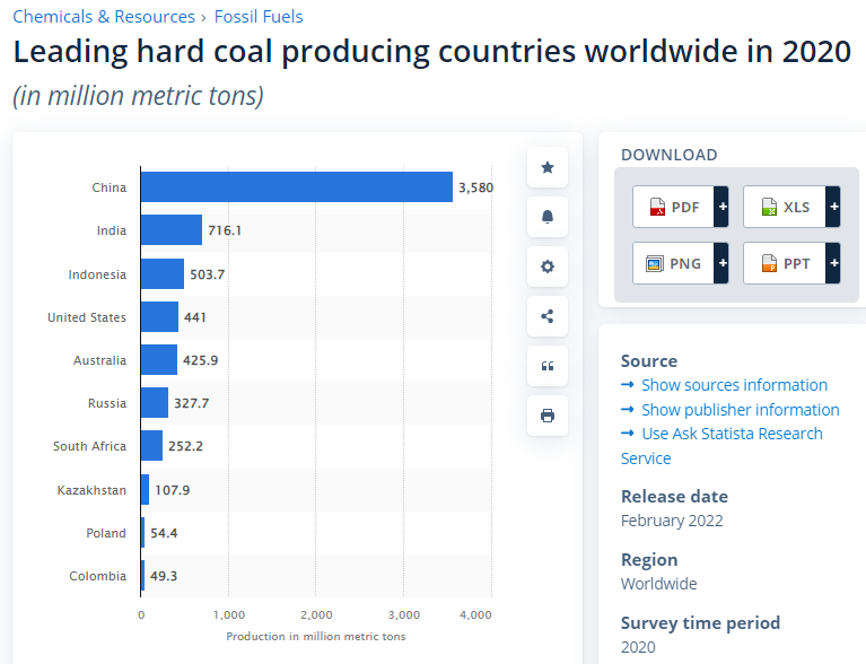

Australia is the second largest exporter of coal and we export good quality thermal coal that reduces emissions in developing countries as it moves them away from less efficient derivatives. Indonesia is the world largest exporter. Worlds’ top 10 countries based on coal production.

China is the largest producer and user of coal and it produces more coal than the next 9 largest coal producers combined and then some! Australia is only 5th and our 425.9Million Metric Tons is less than 12% of Chinese production.

China as a self-declared developing country, has never signed up to the Paris Protocols and has flagged they won’t consider reducing their emissions until they peak in 2035.

If the Solomon’s or any Pacific Island neighbour was rejecting Australia’s influence because of climate change concerns it would not choose China as an economic partner.

The graph below shows leading coal producers worldwide.

Carbon emissions are a GLOBAL issue. If you believe that carbon dioxide is the principal driver for the changing climate, whatever we do here doesn’t help Australia specifically, it is meant to help the globe. By reducing emissions here, we do not impact the Australian climate or the climates of our pacific neighbours, unless the whole globe reduces by the same amount. There is no correlation with what we do and what happens in Australia or the South Pacific.

Global temperatures – according to Nasa’s Goddard institute have risen by 0.8% in the last 140 years

I am not sure how any Australian government solves this issue so Penny Wong will have her work cut out for her.

Energy Wars

While, with the best of intentions many would like to reduce fossil fuel consumption, we need a viable replacement.

Arguably, our children and their children have no interest in having ‘less’. They are already far larger consumers of energy than we were at their age.

The concern is, we are talking about limiting supply without reducing demand. Keynsian’s will recognise the classic problem with this strategy. This pushes prices up.

In fact, we need even more base load power as we want to bring manufacturing home – the ‘de-globalisation’ of the world.

Australian homes already have one of the highest levels of solar panel use and that has helped us reduce our emissions by over 20% since 2005.

Base load is needed for heavy industry and we have several coal mines that will be retired in the near future.

Hydrogen may be a solution but most countries are turning to nuclear as a tried, tested and safe alternative. Public sentiment may be an issue but there is concern vested interests may be discouraging Australia from going down this track.

Will the Albanese government be willing to have this conversation with the Australian voter? The UK has committed to eight new nuclear plants in the next 8 years. France is pledging to construct 14 new reactors plus a fleet of smaller nuclear plants Boris goes Nuclear Macron an the rebirth of France’s nuclear program.

Global Recession.

This is a strong possibility and there are a swag of contributing factors. Interest rates, inflation, conflict, reduced financial stimulus and political unrest.

_________________________________________

With this backdrop it is going to be hard for any government to balance the budget. We already have most of the detail for this year’s budget and it will be difficult for the ALP to wind back a lot of the program without forcing Australia into recession.

Even if they were able to, it is not part of their current policy platform and historically this has not been a strength.

Australia has voted and Mr Albanese and the ALP might not be as excited about this win in three years’ time as they are now!

The above is based on data but the inferences are mine so all counter views are accepted. Hopefully this can lead to some animated discussions at home?

I will finish this piece here as I could do a whole counter argument to a global recession but that would make this an even longer article. (Stay tuned)

As you can imagine, much of the above is well and truly part of the dialogue that we, our consultants and analysts are considering and our Australian Market is already reflecting some of these concerns. The global markets have seen much larger reversals.

Troy Theobald and the team have a number of strategies they are implementing at the moment and over the next few weeks and we will provide more detail in our next update.

As always if you have any concerns, please contact us – we are here to help.