It’s now been 11 weeks since we have moved to our new premise at 9 Ouyan Street, Bundall and in that time the team have settled in nicely. We had the usual NBN issues which also impacted on phones so thank you all for your patience through this time. That is all sorted now and (touch wood) our technology is back up to speed. In our RFS Advice Update back in February of this year, we had let you know that Robina Financial Solutions was slowly being transitioned to RFS Advice and we have since amended our email address and website to reflect this change. The old email addresses will still work but, as an example my new email is pa**@*************************om.au rather than pa**@**********om.au.

Importantly there is no ‘au’ on the end. Our phone number is still the same whilst our website is now rfsadvice.staging-sites.com.au.

If you are having trouble receiving our emails due to our domain name changing, we suggest that you please check your SPAM or JUNK folders. There are ways to add our new email back into your inbox and make it a trusted email. We have added a link below as it depends on your email account. If you need any assistance please call our office and one of our staff will be happy to assist you:

https://www.kinesys.com/resource/how-to-stop-emails-going-to-the-junk-folder/

End of Financial Year Reminders 2021 for Contributions and WithdrawalsLump Sum (one off) Withdrawals

If you are planning any large acquisitions in July that will require drawing down on your investments, superannuation or pension accounts, please be aware that most investment managers delay redemptions in the first weeks of the new financial year as they finalise their end of year accounts.To avoid any issues, we recommend you redeem any cash that will be needed in July, by no later than 14th June 2021 – or if possible, defer any large purchases to late July.

PLEASE NOTE: All your regular payments (pensions etc.) will go through as normal. This temporary hold only relates to one-off withdrawals.

Contributions

If you were planning to make superannuation contributions before the end of this financial year, please allow 5 to 7 working days prior June 30, for your superannuation contributions to be processed by your super fund. We recommend that if you are wanting to make additional super contributions for this financial year please do so by the 21st June 2021. Please see following information about the superannuation contribution caps that are applicable for the 2020/2021 year…

Concessional Contribution Caps for 2020/2021 (Contributions that are Tax Deductible):

The annual maximum amount is $25,000 for each member. This is the total of all employer contributions, salary sacrificed contributions and personal deductible contributions.

Please note, members 67 years and over must meet a work test to be eligible to contribute. All contributions should be cleared on or before Friday, 25th June 2021 and received by the fund to permit a tax deduction.

Non Concessional Contributions for 2020/2021 (Contributions not eligible for a Tax Deduction):

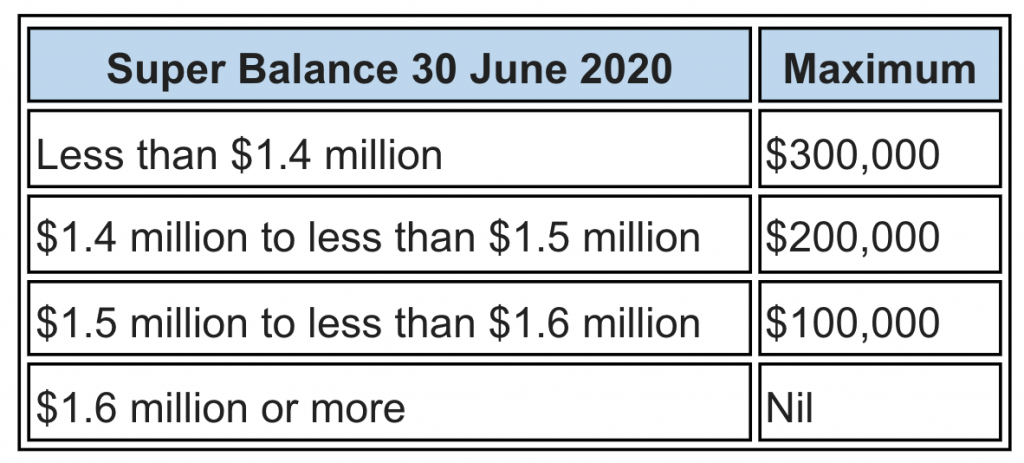

There is a maximum $100,000 contribution per annum after-tax cap and a 3-year $300,000 bring-forward cap. However, there are additional limitations based on individual superannuation balances (see below table).

Please note, members 67 years and over must meet a work test to be eligible to contribute. The bring-forward rules are not available after turning 65.

Limits on the bring forward rules:

If you have any questions in relation to the above, please don’t hesitate to contact our office and speak to your client manager or adviser and we will be happy to help.

Warmly,

The RFS Advice Team.