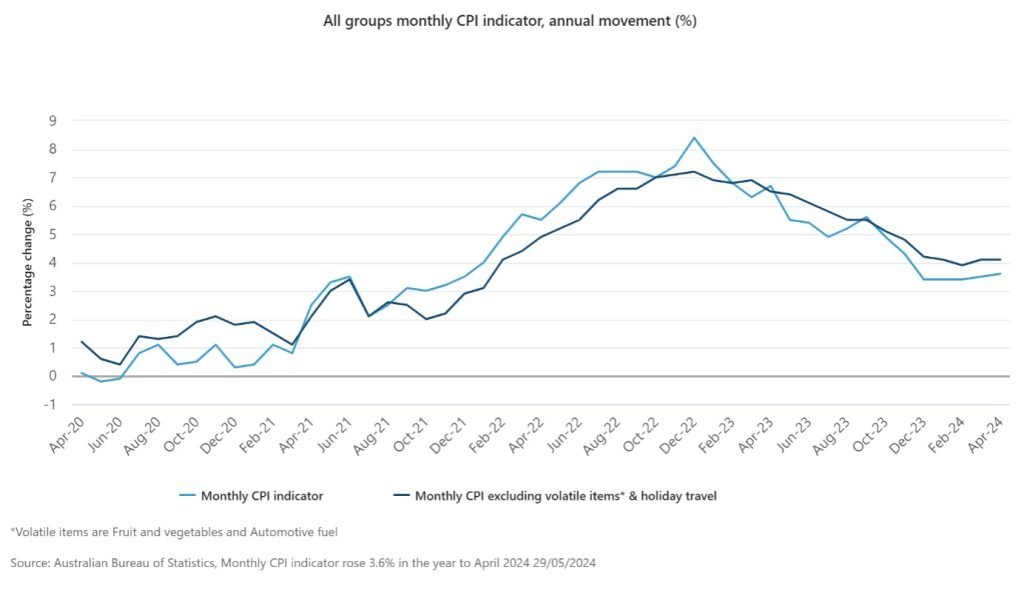

The Covid period is well behind us and the inflationary impacts from supply chains during that period have almost disappeared, yet we still see inflation numbers in excess of 4.0%.

Aust Gov CPI to April 2024.

In the twelve months to April 2024:

- Housing costs rose by 4.9%.

- Rents increased by 7.5%.

- Electricity prices rose by 13.9% but government subsidies reduced this to 4.2%. This means the differential 9.7% was paid to energy companies from your taxes but it is still paid.

- Food/non-alcoholic beverages were up by 3.8%.

- Fuel was up 7.4%.

- Transport was up 4.2%.

Housing and rentals, while still seeing some supply issues, would now seem to be driven by wages and immigration increases.

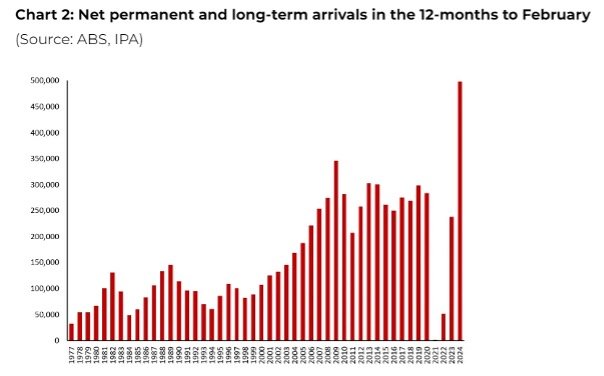

Migration numbers can be exaggerated by temporary visa holders – overseas students working holidays etc., but net permanent and long-term arrivals in Australia in the twelve months to February 2024 were 498,270. The current population of the Gold Coast/Tweed is approximately 743,000 so this equates to about 67% of the Gold Coast moving into Australia in one year.

In February 2024, Australia had 713,000 temporary visas issued to students and 181,000 working holiday makers visas. These numbers would have been increasing across a couple of years but were up from lows in December 2021, of 316,000 and 23,000 respectively. (Combined 894,000 versus 339,000).

You add to this our natural increase, approx. 111,000 (births less deaths) annually and you can see why shelter costs are under pressure.

Having people wanting to come to your country is healthy economically, if they bring skills and pay taxes, but it puts pressure on your infrastructure.

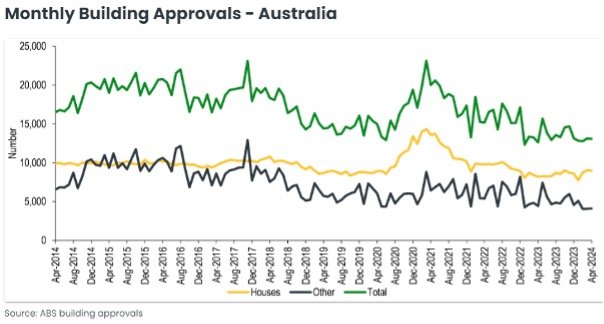

You need more housing and as can be seen in the following graph, approvals are now lower than they were in 2014. The ‘Other’ category is units, semi-detached, townhouses etc.

The additional pressure on building costs is coming from public sector competition for resources. The public sector has its own priorities on infrastructure and is offering big incentives to coax building industry participants to their projects.

As an example, in April the Queensland Premier, Stephen Miles, announced new benefits for the construction industry working on state government projects. These include:

- Double time if you have to work in the rain;

- An extra $1000 a week if their employers work address is 50kms from the work site;

- Not having to work if the temperature gets above 35 degrees;

- Not having to work if the temperature gets above 29 degrees and 75% humidity;

- A phone allowance if you use your own mobile phone of $100 per week; and

- An allowance of up to $11 an hour if you work on a project worth more than a $1 billion.

All of this is great for building industry workers, but private industry cannot compete without significantly increasing their building costs. This also adds substantial costs to all state government projects, which of course are paid for by the taxpayer.

Other inflationary pressures.

Fuel is still expensive and despite large oil reserves in Australia we continue to freight 91% of all fuel from other countries and our refineries are only surviving with government support. Diesel still provides for all heavy rail, trucks and shipping so will be necessary for many years to come.

The Iran backed terrorist Houthi’s continued attacks on ships in the Red Sea is leading to shipping taking alternatives routes that is adding cost to the delivery of oil and fuel to Australia.

As we have said in previous articles this impacts everything you consume and use.

Energy costs are being supported by our state governments, (which actually means the Australian taxpayer) by almost 10%. Additional electricity bill support provided to Queensland residents for 23_24 tax year are at $1.483 billion, on top of the existing subsidies and concessions. Queensland State government subsidies are up by 73.9% since 2015_16 financial year (FY).

These subsidies are still being paid to energy producers so electricity costs have increased by approx. 14% in one year and at some stage that will be worn directly by the consumer. Currently you are still paying for it, just through higher state taxes and reduced services elsewhere. It still comes from the state revenue bucket.

Yes, you can add solar panels and then add batteries, so those solar panels deliver power in a brown out (solar panels don’t provide power in a blackout as they need the current to be modulated by the grid, so you need batteries as well) but that only tends to work for standalone properties, not units or any sort of high density living.

Our energy needs continue to grow.

- A standard electric vehicle contains a 50Kwh battery and even an efficient day of solar from a 6.6kW solar system would only generate 26.4kW of power in a day.

The new outlier is Artificial Intelligence (AI). It is estimated that an AI search and yes, we are all using it more, consumes up to 25 times more energy than a google search.

- Additionally, far more water is then consumed to cool the servers (never really considered this). 20-50 AI queries evaporate approx. half a litre of water (A small bottle). The article below gives some good insights.

https://www.brusselstimes.com/1042696/chatgpt-consumes-25-times-more-energy-than-google

With the very rapid take up of AI solutions it is easy to see we will need far more energy in the future and simply replacing our existing system will mean it is still way behind our future needs if and when we get there.

Our governments need to stop talking about replacement and start considering doubling our supply within the next 10-15 years. People forget that it wasn’t until the 1950’s that nearly all homes in Australia had power and initially it was for lighting and things like radios. Consider what you have plugged into power today and how far that has come in 70 years (less than one lifetime).

Excess Savings.

During the pandemic Australians (and many western countries) accumulated substantial excess savings but the recent data is showing that this has whittled down to pre covid levels in recent months. Some of this has converted to increased net wealth but a lot is simply being utilised to deal with increased interest rates and cost of living. As we have stated previously, the average Australian home loan is approx. $750,000 and the cost of additional interest on that loan verse two years ago (the first RBA rate rise was May 2022) is around $30,000. Households have had to find an additional $570 a week to stay in the same house.

The RBA has pointed to inflation as being domestically driven and this would indicate they believe covid supply chain issues are behind us and the inference is government spending and wage policies are continuing to create inflation.

The government has offered a $300 rebate to all households in the recent budget but if it can get inflation back under control:

- a 0.25% cut in rates is equal to a household saving of $1,875 based on the mortgage above; and

- a 0.50% is worth $3,750.

That 0.5% cut would equate to a $72 a week pay rise.

Time to talk about fiscal responsibility.

Fiscal responsibility will need to eventually return, or the whole of Australia will face the fiscal cliff that is facing Victoria. As Margaret Thatcher was fond of saying, “the problem with socialism is that you eventually run out of other peoples’ money”.

We can look at Victoria, previously one our most vibrant states and very important to the Australian economy, as the canary in the coal mine.

Victorian residents benefited from their state government spending generously on just about everything and that kept Daniel Andrews very popular. Unfortunately, his spending plans were funded by Victoria’s credit card and that means future generations of Victorian’s will be paying for those benefits for many years to come. Even if you don’t repay the debt, the interest costs become an anchor around current and future governments. Victoria’s debt is currently around $156 billion and the interest is quoted as just under $26 million a DAY. At 5.0% interest, that is $9.4 billion a year.

https://www.afr.com/politics/victorian-debt-to-hit-188b-as-labor-budget-shirks-cuts-20240507-p5fph3

Victoria, many would argue, is one of our most attractive places to live, but that is going to be challenged in the coming years.

Consider:

- Victorian state debt is more than NSW, Queensland and Tasmania combined.

- Victoria had to cancel the Commonwealth games due to economic constraints.

- Victoria has the lowest credit rating of all states which means its government is paying higher rates to fund its ballooning debt. WA, QLD and the ACT are all AAA, SA and TAS are AA+ and Victoria is AA. Still not bad but down two levels during and post the pandemic.

- Victoria has the highest property taxes and duties in Australia (other than the NT) and Victoria has seen negative asset price regionally and only 2.8% property value growth in Melbourne over the twelve months to 30 April. (With Inflation at 4.1% that is negative real growth).

By comparison Perth has seen 21.1% growth increase for the twelve months, Brisbane 16.1%, Adelaide 14.0% and Sydney 8.7%. https://propertyupdate.com.au/everything-you-need-to-know-about-the-state-of-australias-property-markets-in-charts/

- In the 23 FY, Victoria had 7,600 fewer businesses registered in the state compared to Qld with an additional 11,000 and NSW with an additional 8,140.

- They have banned gas, which is the logical transition for firming energy and this has seen their energy prices rise higher and faster than any other state. Queensland generated over $9 billion in royalties from coal in the calendar year, 2023. Victorian royalties, arguably due to bans and discouragement of investment are disappearing.

Australia has seen enviable growth across decades and benefited from the many migrants who have moved here and embraced our values and lifestyle. We should not take that for granted. We only have to look at Argentina and Venezuela to see how rapidly that wealth can be eroded by poor management and socialist and communist ideology. We need our governments to focus on economic management which will benefit all Australians and voters need to hold our politicians to account. Time to get back to building a future for our next generations.

Regards,

Paul Forbes, RFS Advice CEO