(8 minute read)

I know it is a dry topic but these changes may have broader ramifications than you think and it has probably exposed an agenda that we will need to plan for.

As a precursor, we still believe Superannuation will be a critical part of the retirement savings landscape, but there are changes coming and they add complexity rather than reduce it.

Additionally, we have time to make adjustments and there are other options to discuss.

The Super wars re-ignited

After some rushed discussions and with no legislation, the Albanese/Chalmers cabinet has decided to create a strategy to raid retirees super to help fund future budget deficits.

The good news is it will be post the next election HOWEVER, unlike the Howard/Costello GST plan, they will legislate it now and push it through both houses so that if they lose the next election, the Liberal’s will need to have control of the Senate to overturn it. Given the current make up that will be fairly difficult for the Liberals. The current senate make up is LNP 32, ALP 26, Greens 11 (after Thorpe resignation) and Hanson 2/Lambie 2/United 1 and Independents 2 (Pocock and Thorpe).

- It would have to be a significant win in 2025 for the LNP to pick up 4-5 seats though they may be able to work with the crossbenches if they did win. That being said, history would suggest it is very unlikely for the Albanese Labor government to only govern for one term.

From an RFS point of view we will need to assume these changes will be implemented though possibly overturned by a future government.

The damage may however, already have been done.

I have been in financial services for 37 years and superannuation has been an increasingly significant part of the retirement landscape for most of that time (The Keating government brought in compulsory super in 1992).

The incentive to lock up future savings for retirement needs trust. Trust that the rules won’t have changed by the time you finally have access to it and trust that the sacrifices you make in the short term will be rewarded in the future.

The attack on larger superannuation balances plays to the ‘politics of envy’ and we have seen these cards played before. Chalmers and Albanese feel on safe ground as many Australians will not be too concerned with fellow Australians who have managed to save more than $3 million.

Small rant!

- It could be argued that those Australians who have created this wealth have contributed very substantial amounts to the taxation system over many years.

- These wealthy Australians have likely never been a burden on the social welfare system and many will have invested in their education and worked long and hard to build wealth for both themselves and our country.

- Many of these Australians will have added value to their communities in engineering, medicine, law, farming and the arts.

- A lot of these Australian’s will have risked their life savings on business ventures that have subsequently employed, trained and inspired the next generation. 60% of small businesses fail within the first three years and there needs to be incentive for Australians to take that risk.

Bill Shorten and Chris Bowen tried this tack in 2019 in the hope of creating a class war and the resounding response was most Australians want a hand up, not a hand out. We want a better life for our children and we will work and save to achieve it.

Government directed investing

The other worrying development for superannuation is the commentary about using super balances for ‘nation building’ projects. This isn’t grabbing as many headlines but it is likely not as well understood.

The government is looking at that $3.3 trillion ‘honey pot’ as the assistant treasurer, Stephen Jones, put it, and how they could direct investing into programs like social housing, climate initiatives and ‘nation building’ projects. That sounds great except… it isn’t their money.

In truth it would be hard to impose this sort of direction on trustees of self-managed superannuation funds but trustees of industry funds and their default options may be feeling this pressure.

It isn’t widely reported but large industry funds are already very substantial owners of Australia’s renewable energy assets in both wind and solar. This may be why they advocate so strongly for continued investment in these areas but investing heavily in taxpayer funded initiatives is not necessarily a bad idea.

https://financialnewswire.com.au/superannuation/industry-super-funds-have-power-literally

Industry fund investment in renewable assets may be quite prudent and if they stack up as a solid investment, any trustee of a super fund could consider them. Where this is a concern is using private superannuation balances to fund projects that prudent investors do not want to support. If professional investment managers and private equity houses do not want to invest in it, why would it be a good idea for your retirement savings?

When we start seeing current governments directing the use of your investments because no one else wants to take the risk, a lot of superannuation investors will get very nervous. A trustee’s role is to work in the best interests of the members within the fund, not the vested interests of the government of the day.

Taxation of unrealised capital gains

This latest revelation is a precedent that all Australians need to pay attention to.

There is speculation that the governments’ difficulties with its social agenda might have been the reason they rushed their potential changes to Superannuation to market. They may have hoped this controversy would drown out the fairly vocal negative commentary that is coming from some sectors.

Based on initial surveying the government was right to predict that many Australians do not care about fellow Australian’s with large super balances, but in their rush to get this dialogue out there, they really haven’t thought it through and they have ‘accidentally’ (giving them the benefit of the doubt here) created a new tax system.

To implement their changes they need to assess the value of a members balance. Earnings on anything over $1.7m (moving to $1.9m 1 July) are already taxed at 15% within superannuation. (It can be more complicated than this with transfer caps but that is an article by itself).

The new rules from 2025 would mean a member with over $3mil would be taxed at 30% on both earnings and unrealised capital gains on any valuation increase above the previous years balance. You might have a commercial property or investment property in your Self-Managed Super Fund which puts your balance through the $3 million cap and any upward change in the valuation would be treated as taxable income. Australian – The hidden sting

NOWHERE in our current system is this sort of tax applied.

An example:

If your balance was over $ 3million and you held a $600k investment property in Mullumbimby that grew by 50% (which was the average median growth in Covid era – see article below*) that would leave the owner with an additional $300k of income to be taxed at 30%. The fact property values then dropped by 28% in the 22_23 year would not help you. You would have had to pay your tax and in this year you wouldn’t get a refund. Incidentally, the 10% Capital Gains Tax discount rules would not apply.

In our current tax system you are taxed on earnings not unrealised gains and this ‘possibly unintended’ consequence needs to be removed, before it gets any more oxygen.

Is this your problem?

Mr Albanese and Jim Chalmers initially said it would only catch around 80,000 Australians. He was then forced to admit that it would also catch up to an additional 500,000 public servants, veterans, judges and politicians like him, who are on defined benefit funds.

Both Mr Albanese and Mr Dutton are beneficiaries of the pre 2004 government defined benefit schemes and there are 212,000 of those accounts still in accumulation phase – i.e. they haven’t retired yet. The other 288,000 are currently in retirement phase.

Mr Albanese’s salary is currently $564,000 – not unreasonable for the most senior role in the government but well under a lot of senior public servants salaries. AFR – Top 24 Public Servants

Number one is Stephen Rue, CEO of NBN whose salary and super grew to $2.93 million in 2022.

If we just looked at Mr Albanese, on retirement he is entitled to a pension for life of approximately $350k INDEXED (unlike the $3mil cap). His partner (who is 15 years younger) would then get 83% of this pension on his death – also indexed.

Defined benefit schemes have a deemed capital value and at 4% it would be $8.75 million for his $350k pension. This AFR article then calculates it to be worth $20 million if you include his partner’s pension entitlements

AFR – Super tax spotlights politicians pension largesse

This creates a whole new set of complications and apparently none of this has been modelled.

The lack of indexing on the $3 million cap is also forecast to impact up to another 400,000 Australians in accumulation phase over the next 30 years.

The Family home

Arguably because of the loss of credibility after these announcements (“there will be no changes to superannuation” was straight from Mr Albanese’s lips only 19 days before the election) Mr Albanese was forced to categorically deny they were also ‘looking’ at capital gains tax for the family home.

- Weirdly though while he and his colleagues have never discussed it, someone must have been, because they can quote all the statistics on what they believe it is costing the budget?

- As we said last week, the family home is bought and maintained in after tax dollars. There are no concessional tax breaks for the value created in the home, unlike investment properties. Yes, it is not included in the assets tests for pensions but we would argue these home owners should not be forced to sell a house they have spent their whole life paying off. Their home is where they want to live in retirement.

Once the ‘super storm’ is behind them is it that unlikely that introducing some caps on the family home ‘which only effect the rich’ could be worth a bit of kite flying?

And we are back to Franking credits!

Arguably, Labors’ loss in 2019 was in no small part to attacking retirees and a part of this was franking credits. To their credit they were transparent on their desire to introduce a whole new regime of taxes and most would agree that lost them government.

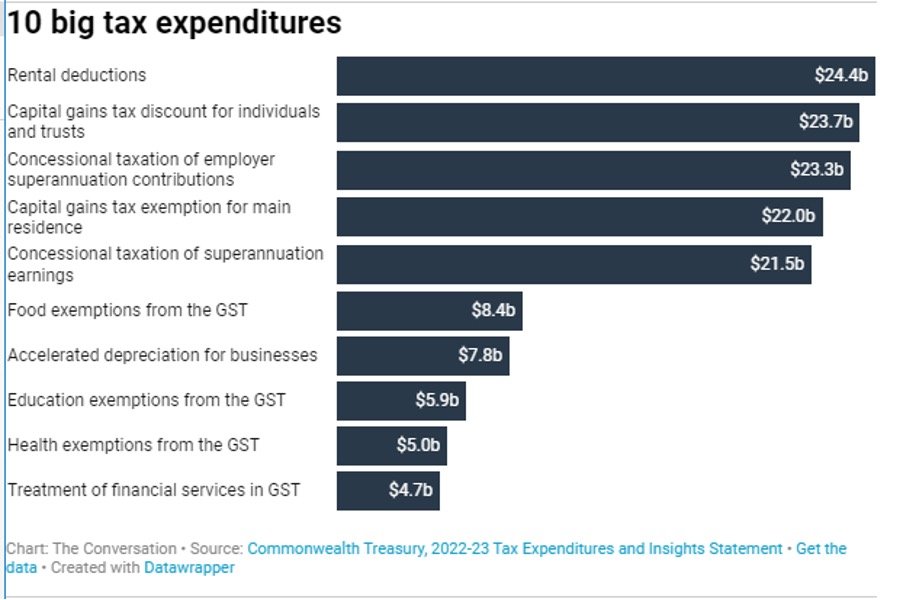

Jim Chalmers may have started with super but the list below was released by him on the 28th of February 2023 and Superannuation may just be the first salvo?

So now I have depressed you all… there is good news!

We have a couple of years to digest this and yes we can already see ways to minimise some impacts.

Superannuation may be only ‘one of the best’ retirement options in the future, but it will still play an important role for many Australians. We may just have to be a little more innovative in solutions outside of superannuation as well and, in the long run, that may be a good thing.

As always, if you have any concerns or would like any additional information, please do not hesitate to contact us.

Best Regards

Paul Forbes

P.S. I have attached a lot of links in this article and many of them will be only available to subscribers of the Financial Review and The Australian (Yes both very exciting reads). If you would like to view any of the articles just email a request to in**@*************************om.au with the article you are after and we will get a copy to you.