THE G.O.A.T

In sporting parlance, the G.O.A.T. is the greatest of all time. Think Michael Jordan for basketball, Wayne Gretzky – ice hockey, Tiger Woods or Jack Nicklaus for golf, Michael Phelps for swimming and Wally Lewis for state of origin. Okay that last one could be disputed but just getting our NSW readers attention – maybe Mel Meninga, Billy Slater, Darren Lockyer or Johnathan Thurston?

All of these athletes were and are exceptional but I think we could argue that of all the people on the planet, Queen Elizabeth II may well have been the GOAT when it comes to selfless public service, dignity, grace and duty.

I am sure you don’t need to hear more accolades – the media has been wall to wall on this and, I would argue, all thoroughly deserved. In the 70 plus years of her reign, she dealt with 15 British Prime Ministers, 16 Australian Prime Ministers, 14 Presidents and 7 Popes. That is a very large chunk of history and she kept the constitutional monarchy and her family together. (No guesses to which was the more difficult)?

Queen Elizabeth II, rest in peace. You were admired from all parts of the globe.

We now have King Charles III? ‘Uneasy the head that wears the crown’ (William Shakespeare). One might say he has a few challenges? (Am I the only one who keeps visualising a spaniel when I give him that title)?

_____________________________________________________

Is anything else happening?

The death of Queen Elizabeth is a historic event and not surprisingly any other news has struggled to get traction but there has been some and it does impact investment markets.

Jerome Powell (Chair of the Federal Reserve of the US) in his Jackson Hole speech on the 26th of August, provided some certainty for the Fed’s commitment to bringing inflation down.

Unfortunately the US is already in recession so more aggressive rate rises can lead to a significant slowdown in the US which eventually leads to changes in trade, consumer buying patterns, employment and confidence. The USA is now 59.9% of the world share market (at January 2022) so what happens there, matters.

The next largest is Japan (6.2%) which has its own senior management issues with the assassination of its former Prime Minster, Shinzo Abe on the 8th of July 2022.

The United Kingdom is third with 3.9% and then China at 3.6%. China is the worlds’ second largest economy and a very important trading partner of Australia, but in regards to equity markets, it is not a huge player.

A lot of the current Federal Reserve Bank strategy is based on the assumption this recession and inflation mirrors previous recessions. An alternative view is that the hyperinflation we are seeing could be the result of a confluence of very unusual events:

- The closing of world economies due to Covid;

- Massive fiscal stimulus to maintain western economies;

- Substantial increases in consumer savings;

- A reopening of economies with pent up demand for travel and experiences and supply chains in disarray;

- The invasion of Ukraine by Russia and the subsequent energy crisis in Europe, particularly Germany which is the European Economic power house; and

- The energy crisis more generally with the accelerated move to renewables putting pressure on investment in traditional energy sources.

Inflation easing?

Oil/Fuel Prices

In the US we are already seeing fuel prices reduce and that has been reflected here in Australia. https://tradingeconomics.com/commodity/crude-oil

Oil prices have moderated and this is coming through with prices at the fuel pump.

Falling fuel can actually be a better economic stimulator than interest rates as it is very transparent and easy to compare. Interest rates can go up and down but many people make payments above the minimum payment amount at a fixed rate so the impact on their wallet is not immediately apparent.

Lumber Prices

Another good US inflation indicator is lumber prices and the graph below maps the Chicago Lumber futures over the last five years. US home owners have seen mortgage rates accelerating at even faster rates than Australia and these lumber prices are the combined influence of higher mortgage rates reducing spending on renovations and reduced housing starts, easing demand pressures and supply chains improving. https://tradingeconomics.com/commodity/lumber

Shipping costs

Supply chain costs are starting to ease. The global container index is below.

Cost of shipping containers had been fairly steady pre-pandemic at around US$1,500. They peaked in late 2021 at almost US$11,000 per container and are currently around US$4,800. Still high but heading in the right direction.

Despite this, the August inflation number for the US was higher than expected and this is being driven by rent, healthcare, restaurant meals, home furnishings and car repairs.

As I write this article, US markets had a big fall overnight (13th September 2022) and this is being attributed to a larger than expected inflation number, 8.3%.

COVID19 still having major impacts on our imports.

While here is Australia and for most of the developed world Covid19 is only really noticeable when you visit hospitals and aged care residences, our largest trading partner is still creating manufacturing havoc with shutting down whole cities.

If you click on the link below it will give you access to the China Briefing website and you can quickly see that Covid pandemic measures are alive and well in China. An example is the Chengdu metropolis, with a population of 21.2 million people, which was locked down 1 Sep due to 157 reported cases. They then set about testing the whole city. This is not dissimilar to locking down the whole of Australia and testing the whole country.

There is a lot of speculation that the Chinese Sinopharm vaccine is not as effective as the western options which could account for their ongoing concerns but this is disrupting productivity, transport, shipping and food services.

China does have some safety nets for their workers but these are definitely not as generous as the JobKeeper solutions that were provided here and general economic prosperity is in decline which could cause concerns for the ruling Communist Party.

Europe:

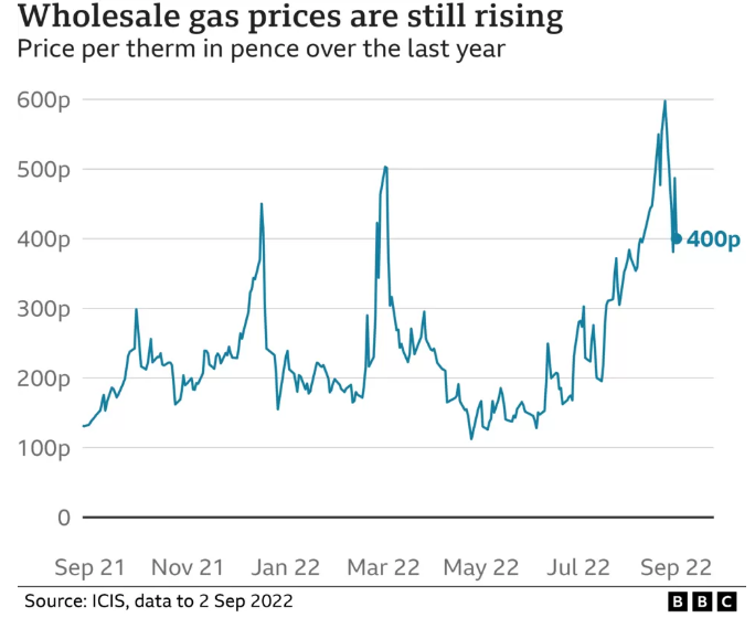

There is large focus on energy issues in Europe and recently Russia shut down the Nordstream gas pipeline to Germany for ‘maintenance’ (31st August 2022). https://www.bbc.com/news/business-62789675

Not unexpected but this has ramifications for Europe, the UK and even Australia as the price of Natural Gas soars.

Other news that is not gaining as much traction is the likelihood that access to debt for countries like Italy, Spain and Greece may be drying up very quickly. With the European Community reassessing its appetite for debt the costs of borrowings for these countries may start reflecting the underlying risks a little more commercially.

These countries are still running large government deficits and to fund their spending they need to borrow. If the source of these borrowings dries up, they will need to source their debt from elsewhere and that could be a very painful experience.

This may also have broader ramifications for the Euro and the European Economic Community.

Ukraine:

Ukraine is having some success in reclaiming areas that had been taken by Russia. https://www.washingtonpost.com/kidspost/2022/09/12/ukraine-retakes-territory-in-northeast

This is good news but will be putting pressure on Putin and his military and there is some trepidation on how they will react so celebrations will be subdued at the moment.

Australia:

Australia itself has very low unemployment, arguably low interest rates (certainly lower that historical norms), positive Gross Domestic Product growth (GDP), very strong trade surpluses and a lot of healthy companies with very little leverage.

Our building industry is struggling as developers have been dealing with supply cost increases but we have very low rental vacancy rates – a record 0.9% nationally in August. There is pent up demand so a recovery would be expected as the costs ease.

Summary

There is a lot of news beyond the death of Queen Elizabeth II and in our financial world, we are pretty focused on that.

Inflation is still driving pricing volatility as interest rates are likely to continue to rise. There are also solid indicators that upward pressure is easing. As inflation drivers weaken, central banks are likely to return to a more neutral position and this would usually be a positive for markets.

The aggressive rate rises in the US are the key concern as that could lead to a deeper recession in the US. The Federal Reserve and our own Reserve Bank are unlikely to say interest rates rises will slow, even if that is what they believe. They want consumers to reduce spending and they would prefer that happened through the consumer believing that rather than them actually raising rates.

Eventually China will ease its Covid restrictions.

- Some would argue that this won’t happen until Xi Jinping is re-elected on October 16th and that could be true but that is not far way now. This will increase productivity, improve transport and ease supply chains.

- The Taiwan concern remains and no doubt the Chinese Communist Party is watching the Ukrainian/Russian conflict and the West’s response very carefully.

There are a lot of moving parts in this environment and, as per usual, investment markets are reacting and trying to predict impacts. The news I have talked through above is already part of the current pricing and markets are likely to move based on both positive and negative news.

At RFS, we manage for the medium to long term rather than trading based on short term sentiment. We can see a lot of opportunity in this market and yes, a lot of good quality shares are likely to be more expensive in the medium term as some of these fears lessen – we just don’t know exactly when.

As always if you have any concerns, please do not hesitate to contact us. We are here to help.

Best Regards,

RFS Advice CEO,

Paul Forbes