There is a lot going on at the moment so hopefully the below will give you a quick snapshot of some of the issues that impact on investment decisions.

RFS Advice on the move.

I just wanted to cover off a question raised by a number of clients about our move that reminds us we should always look at our updates through your eyes.

The concern was, that with the name change from Robina Financial Solutions to RFS Advice and the change of premises, were we bought out or had we merged with another business. The answer to that is a definite, no. The name change is really to simplify our ‘search-ability’ – a social media term, and in recognition that we aren’t in Robina anymore – or soon won’t be. We still love Robina and will look to do our movie night at the Robina Event Cinema’s but the RFS Group’s new home will be Bundall. There is no change to the ownership or licence and you will still be met by the same friendly team, they will just have more space – which was very much needed.

Enough about us.

Vaccines

As planned, the AstraZeneca vaccine arrived in Sydney on the 28th of February, which adds 300,000 doses of vaccine to the existing roll out of the Pfizer vaccine. The Pfizer vaccinations started the previous Sunday on the 21st February.

As you would be aware, many countries have started their program well before us and Israel is leading the way with 54.1% at 27th February of their population having received their first jab. 38.3% have received both of their shots. The science talks to 60% at least being vaccinated to achieve herd immunity.

Not far behind Israel is the Seychelles with 52.5% and then United Arab Emirates 35.2%, United Kingdom 29.0% and United States with 14.5%.

There is the usual politicking by various states in Australia but the program is underway and should gain momentum. The current forecast is for the program to achieve 20 million vaccinations by October which is most of the Australian adult population. Charting Australia’s Covid19 Vaccine roll out

There are still concerns about variants and chance of ‘mutant’ strains impacting on the effectiveness of the vaccine but even the UK strain which is slightly more contagious than the standard strain does not seem to be any more dangerous and the medical advice is that vaccines are further reducing the chance of serious illness. Risks with Covid19 variants, Vaccines cut risk serious illness by 80% The media talks to ‘mutants’ and the doctors talk to ‘variants’. I think variant is far less scary so we will stick with that.

Why are vaccines important to the economy?

The opening up of borders (domestic and international) is the obvious answers but it goes to the much bigger issues of business confidence, investment, employment, trade, and general prosperity.

The Australian Economy

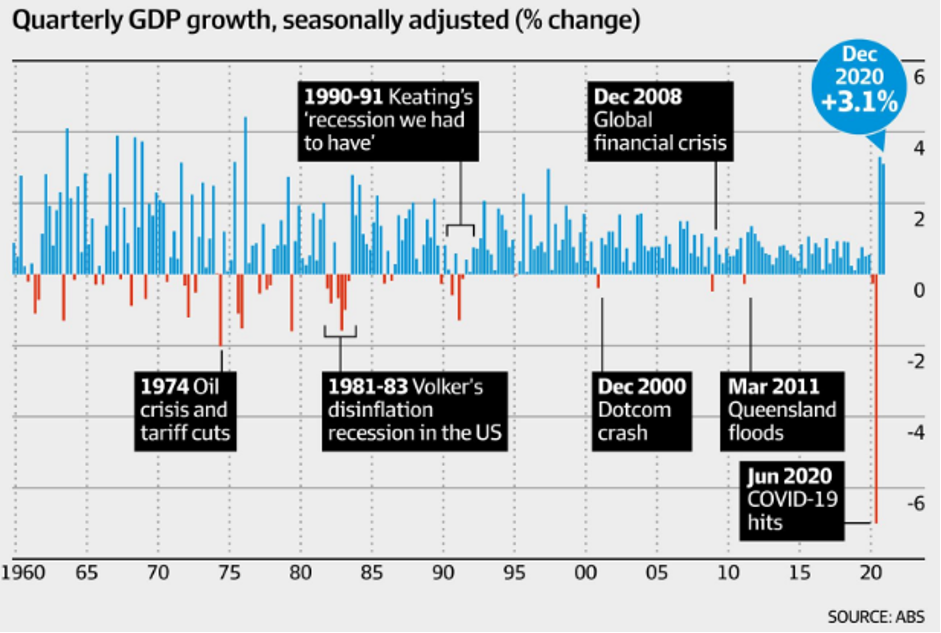

The Gross Domestic Product (GDP) growth for the December quarter was well above economist’s expectation and recorded a record of two consecutive quarters of more than 3%. The economy is within 2% of its pre-pandemic levels.

Unemployment has dropped to 6.4% back to April 2020 levels. The rate in December 2019 was 5.1% so there is a way to go and the hardest hit sectors in the tourism and entertainment industries are a long way from recovery.

The sectors that have driven GDP growth is ‘Household Consumption’ followed by ‘Business investment’ and ‘Dwelling investment’.

The December quarter has been an important indicator as direct government support halved and the market expected consumption to reduce. In the December quarter, 320,000 new jobs were created and 2.1 million Australians came off JobKeeper.

Australian households actually saved $187 billion in the calendar year 2020, which was more than the cumulative 3 ½ years prior to 2020.

Extraordinarily, Australia’s GDP was $1.92 trillion for the calendar year 2020 versus $1.97 trillion for the calendar year 2019. When you think about lock downs and disruptions in 2020, this is a very strong result.

https://www.afr.com/policy/economy/economy-jump-3-1pc-in-december-quarter-20210303-p577a8

So are all things rosy?

Well there is a lot of cash around and yes a lot of that has been federal stimulus. The question is what happens when it slows to a trickle?

- Until 31 March 2021, there is still a coronavirus supplement in the JobSeeker payment though this was reduced on 1 January. This will cease on 31 March but JobSeeker will increase its old rate by $25 a week from 1 April.

- JobKeeker drops out at the end of March and businesses that cannot afford to pay staff will have to let them go.

- Vaccines are here but no one is opening international borders and international tourism and students won’t be arriving in any increased numbers for a while.

This cash matters and adds to our whole domestic economy. There are flow on effects everywhere. Think of retail and food, childcare, cafes and restaurants, property repairs, maintenance and development, and then telecommunications and entertainment.

Just about everywhere you look, you will find this cash has had a positive impact but to quote Margaret Thatcher ‘The problem with socialism is that you eventually run out of other people’s money’.

This largess has to end at some stage and 31 March 2021 is the date. There is a good chance that discussions are going on behind the scenes on some of the severely pandemic affected industries but the broad federal stimulus packages will dry up.

Vaccines will help build our next normal which needs to restore employment for that group of Australians who are still most impacted by the pandemic – the missing 1.3% of our working population.

So will strong economic growth drive asset markets?

Strong GDP growth, pent up demand in building and infrastructure, a vaccine improved international backdrop and a release of some of those domestic savings could all lead to a very different landscape in the next twelve months.

If the markets see inflationary pressure pushing bond rates up, it is very likely we would see some price rationalisation – that is code for volatility and price adjustments, down.

Alternatively … the markets may still have quite a lot of performance left in them and it is important to note that the stocks that have been driving market growth may not be the drivers in 2021 and beyond.

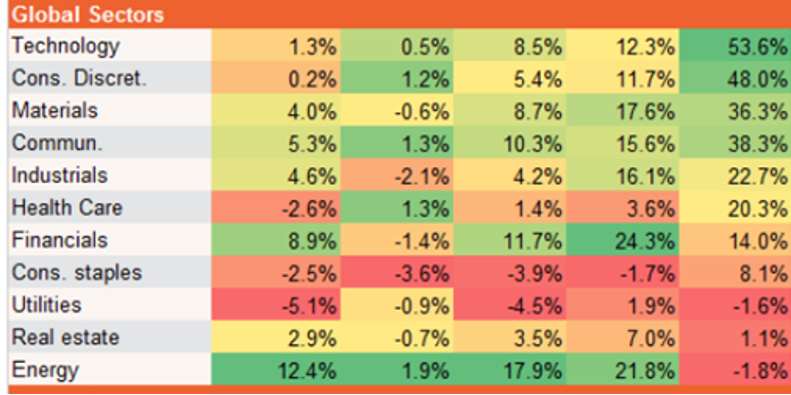

Technology and ‘discretionary’ consumables (think cars, boats) and materials (building, Bunnings) have had a great pandemic and they may still have some way to run but they have definitely become expensive. At this part of the cycle we see our active managers taking some profits and using the proceeds to pivot to good quality ‘unloved’ stocks.

The table below is the performance by sector, 1 March 2020 to 28 Feb 2021 (12 months). A bad year for utilities, real estate and energy but good options in these sectors could rebound with an ‘emerging and travelling’ world population.

We remain cautious and as per our communication in February, an issue with the vaccine roll out or a more aggressive variant could easily derail the current optimism in the markets. We have seen this would be dealt with, but there would be some good buying opportunities in the interim.

It is also a good time to look at taking ‘some’ risk off the table if your portfolios have done really well and this is something we will be talking about in your progress meetings.

Markets reacted to ‘case’ numbers in 2020 and this year they will react to the ‘vaccine’ numbers. We and our analysts will just continue to look for good quality assets that can perform in a recovering world economy and avoid the noise that really doesn’t reflect value.

As always, if you have any concerns, please talk to us.