Well the results are in and to all the respondents – and there were some 143 of you – a very big thank you. We appreciate so many of you taking the time to give us some very valuable feedback.

The third party – Business Health – who coordinated the survey and collated all the data – were very impressed.

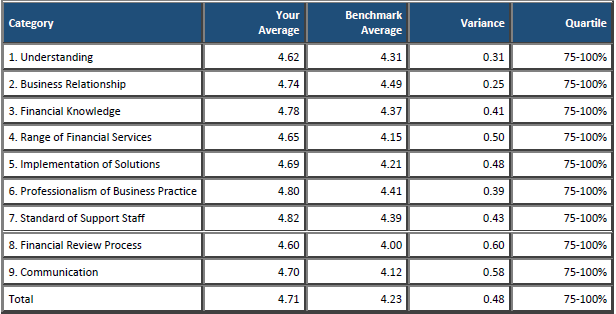

They provide a report to us on nine key performance indicators and compare us to other practices that have had their clients do the survey – they have an existing data base of some 40,000 client responses. Business Health has been providing this service to practices all over Australia for over eight years so it is a robust peer group for a comparison.

They did go to great pains, in the initial phase, to explain to us that a bad result in this survey is not that bad, as it is a premium peer group, so we hoped for good news but were prepared for a little bad…

The report was provided to us on Tuesday and as you would imagine, the team opened it with some trepidation.

(Deep breath and queue drum roll.)

Frankly, the results were excellent and Business Health confirmed this as unusual. In all nine KPI’s, RFS was rated in the top quartile of all practices that have participated in this review.

The table below is an excerpt from the report. The maximum rating is 5, so as you can see the majority of you and your fellow clients, are very happy with the service.

There are definitely things we can work on and while still a very good rating, ‘The Financial Review Process’ was our lowest relative mark (4.60 out of 5) though it had the largest variance to the industry benchmark (0.60). This may indicate that while we are doing a reasonably good job during progress meetings, there is more to be done, not just by us but as an industry. We already have some plans in this area and you should be noticing some changes over this next six months.

The ones as a business owner that we are most excited about are the high marks our clients have given us for the standard of our support staff, the professionalism of business practice and our financial knowledge. We get a lot of feedback on the team, as well as the advisers, and they love hearing you appreciate them and the work they do. We also invest pretty heavily in their education and the fact that this is noticed makes it far less painful when it comes to paying those course fees.

We had some great supportive comments that we will share on our website and social media and some good feedback on where we can improve.

Another area we will look at is how we can provide more timely portfolio valuations, as in volatile times these are moving around a lot. A number of clients mentioned getting more regular updates and though you can see your portfolios on your logins, you have to do a little more work to actually see how you have gone over longer periods and relative performance to benchmarks. We will see what we can do here and this might also be about providing some training on navigating the investment websites as well as providing snapshot views more regularly when there is a lot of market movement.All in all a very productive exercise for us and a big thank you once again for everyone who participated.

Hopefully, with your input, we can provide that extra ‘surprising’ level of service that we, at RFS, always strive to deliver