General advice warning:

The information contained in this report is for information purposes only and makes no recommendations. It has not taken into account your personal circumstances and situation and accordingly, it is not financial product advice and should not be relied upon as financial product advice. Please speak with a financial adviser before making any investment decisions.

Before we start today, we just want to reiterate our general advice warning above and remind you that we recommend that you seek your own personal advice for your household in relation to the concepts and options that we’ll be looking at today. These are not personal, specific advice strategies and may not be appropriate for your household.

In this morning’s show we wanted to address the current market volatility caused by the announcement of Trump’s worldwide tariffs. We will consider how different investors react, what tariffs are and the history of them, how this will affect Australia and some tips for navigating market volatility.

What are we seeing from some of our clients:

Family 1

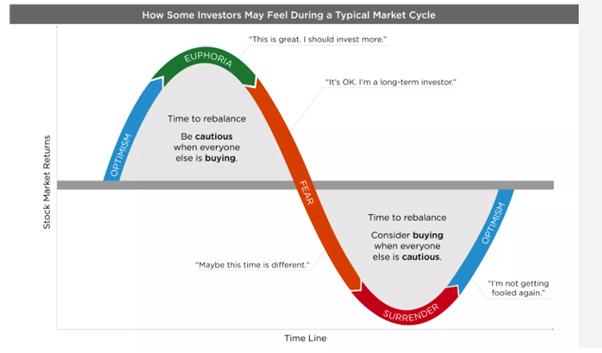

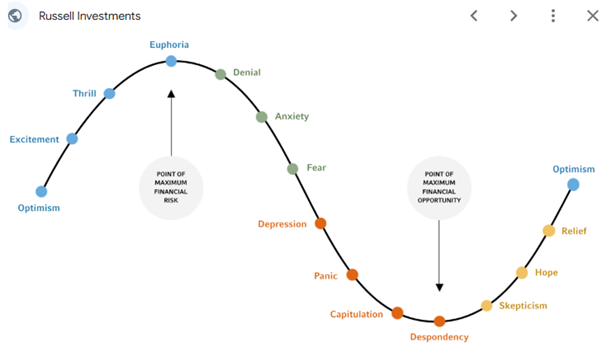

One family will come in wanting to sell everything. When we ask why, the typical response is that they feel uncomfortable and when things improve, they will then reinvest.

What they are really looking to do is to sell when markets have reacted negatively and their balances are showing negative market movement, and then when markets improve, they then wish to buy back in, which can sometimes be at the top of the market. This is an extremely dangerous way to manage money. You have multiple timing decisions to try and manage and what if after you buy back in there is another pullback? What next?

HOWEVER: You may be so uncomfortable that you cannot sleep and it’s causing you too much anxiety, this is what we call the sleep test. Investing in cash or a large portion in defensive investments may be the way forward for you. Everyone is different.

Family 2

This family would be opposite to Family One. They will come in or call up and want to add more into their portfolio and take on more risk during periods of market volatility and uncertainty. They are prepared for the short-term volatility in the belief that markets will improve at some point in the future and they are prepared to wait for that time. They consider that buying during this time is accessing quality stocks at cheaper prices. They may have longer investment timeframes compared to other families.

Family 3

Family Three are different again and are more comfortable to ride out the negative market movements. They understand that you can’t predict markets but you can certainly plan for them and they have made their plans in the past.

These families would have sufficient cash buffers already in place and enough cash reserves to ride out the market cycle. This means that if they need to make any withdrawals out of their investments, they are withdrawing from the cash component and not drawing down on underlying investments that may be lower in value during this period.

For these families, their portfolio’s generate income and growth, so they simply draw on the income to top up the cash buffer until things improve. Their portfolios are also reweighted each quarter back to the original asset allocation which can take advantage of the current market situation.

What family situation do you see that you’re in or want to be in?

Focus on the Strategy, not the news.

The last two weeks have seen turmoil in investment markets around the world. There is so much noise out there and we would encourage you to not focus on what the media are reporting on, which can quite often be scaremongering, and speak to your adviser around the strategies that you have in place to seek reassurance about your own personal situation.

Let’s have a look at what has caused these spikes in the market.

We found this article written by The University of Queensland by Professor Shahar Hameiri. Professor Hameiri is a political economist with the School of Political Science and International Studies and provides some interesting insights and explanations around what is happening: https://www.uq.edu.au/news/article/2025/04/trumps-tariffs-explained

Here are some extracts from that article.

What is happening?

On April 2, the Trump administration held “Liberation Day”, when it introduced “reciprocal” tariffs aimed at countering what it sees as unfair trade practices inflicted on the United States by other countries.

The tariffs Trump announced on this day stunned governments and global markets in their severity. The US introduced a minimum 10 per cent tariff on all countries, but much higher tariffs on many important trading partners, including of course, China, whose exports will now be subject to 54 per cent tax, but also close US allies like Japan (24 per cent) and South Korea (25 per cent).

While Trump claimed the US was being lenient in not imposing full tariff reciprocity on other countries, it was soon revealed that the US government used a bizarre formula to calculate the scale of other countries’ tariffs on US exports. Remarkably, the Office of the US Trade Representative simply divided the US’s trade deficit with each countries’ exports to the US. They didn’t even include US services exports in calculating the deficit. Furthermore, the US even imposed tariffs on uninhabited islands, as well as on Diego Garcia Island, thus effectively taxing its own military base.

How do tariffs work?

A tariff is a tax on goods or services coming into a country. The cost is generally passed on to the consumer – meaning the imported goods or service become more expensive. Trump, however, repeatedly refers to tariffs, erroneously, as a tax on foreigners.

Why is Trump doing this?

It is difficult to understand the thinking behind Trump’s actions.

Tariffs can be useful to build up particular industries and shield them from imports, as part of a wider economic strategy in the service of economic or national security objectives. But such a strategy is hard to discern in Trump’s crude and sweeping measures.

Furthermore, Trump has justified the tariffs both as offsetting the revenue gap created by his tax cuts and as pushing companies to set up factories in the US. The two things operate at cross-purposes. If the latter succeeds, then tax revenue from tariffs will decline.

Furthermore, after decades of globalisation, most goods are often made via long and complex global value chains. Even if the final product can be made in the US, sometimes the intermediate goods or the capital goods – the components that go into the making of the final product and the machines used in the process – often come from other countries.

Therefore, US prices will likely rise, causing inflation, which is exactly the opposite of what Trump promised the American people. What does it mean for Australia?

Australia has had a 10 per cent tariff imposed – which is the lowest level imposed by the Trump administration.

The US exports more goods to Australia than it imports from us. We are one of the few countries in the world that the United States runs a trade surplus with. We are not the kind of country that Trump would have issues with. Furthermore, the overall size of our bilateral trade with the US is relatively small, so it’s unlikely the 10 per cent tariffs will have a major impact on Australia’s economy directly.

On the other hand, some of the biggest tariffs were imposed on countries in East and Southeast Asia – notably China, Japan, South Korea, Malaysia, and Vietnam – that are very significant buyers of our commodities and services.

The tariffs could therefore have a very serious indirect impact on Australia’s economy.

And then there is the potential impact on the US dollar, which is going to rise because of these tariffs. Given the US dollar’s global role, this will have global implications. Should inflation rise again in the US, leading the Federal Reserve to increase interest rates, global borrowing costs will rise, slowing economic activity.

The bigger story, beyond these more immediate issues, is the impact of Trump’s tariffs on the world trade system and the global economy more generally. Economic globalisation, enabled by trade liberalisation, has completely reshaped how goods and services are produced and consumed globally. Trump seems to attempt to reverse processes that have played out over decades almost overnight. Whether Australia can still thrive in the new world order is unclear at this point.

But Trump’s actions raise issues for Australia that extend beyond their economic impact. The erratic behaviour of the US administration means we must also think carefully about the security implications of our relationship, especially as geopolitical rivalry between the US and China is intensifying into what some have called a new or second Cold War. Is AUKUS (a three-way security pact between Australia, the United Kingdom, and the United States) still the best means of securing Australia? For now, there are many more questions than answers.

For further understanding, we created a summary on the history on Trump’s tariffs:

Overview of the Trump Tariffs (2018–2020)

Purpose and Goals

- Aimed to reduce the U.S. trade deficit.

- Intended to protect American industries from foreign competition.

- Used tariffs as leverage to negotiate better trade deals.

- Targeted unfair trade practices, especially by China.

China Tariffs

- Imposed tariffs on hundreds of billions of dollars in Chinese imports (under Section 301 of the Trade Act of 1974).

- Justifications included:

- Intellectual property theft.

- Forced technology transfers.

- Government subsidies to Chinese state-owned enterprises.

- China retaliated with tariffs on U.S. exports (e.g., soybeans, pork).

- U.S. farmers were heavily affected; the government provided billions in aid to offset losses.

Steel and Aluminium Tariffs

- Tariffs of 25% on steel and 10% on aluminium (under Section 232 of the Trade Expansion Act of 1962).

- Applied to imports from many countries, including allies like Canada, Mexico, and the EU.

- Justified on national security grounds.

- Sparked tensions with traditional U.S. allies and led to counter-tariffs.

Impact on U.S. Economy

- Helped some U.S. manufacturing sectors and domestic producers.

- Increased input costs for manufacturers relying on imported materials.

- Led to higher prices for some U.S. consumers and businesses.

- Trade uncertainty caused volatility in global supply chains.

- Studies suggest a small negative effect on U.S. GDP.

Trade Deal Renegotiations

- Replaced NAFTA with the United States-Mexico-Canada Agreement (USMCA).

- USMCA included:

- Stronger labour and environmental rules.

- Updated regulations for digital trade.

- Mostly preserved core trade provisions from NAFTA.

Supporters’ View

- Saw tariffs as a needed corrective measure after decades of trade imbalance.

- Believed tariffs brought countries like China to the negotiating table.

- Viewed as a strategy to revive domestic industry and increase leverage.

Critics’ View

- Argued tariffs hurt consumers and businesses more than they helped.

- Said they damaged relations with allies and partners.

- Pointed to retaliatory tariffs and economic costs, particularly for farmers.

- Claimed the benefits were limited and the overall approach inefficient.

Conclusion

- Marked a shift toward protectionism and unilateral trade action.

- Raised awareness of legitimate trade issues, especially with China.

- Sparked ongoing debates about the long-term effectiveness of tariffs.

- Reshaped U.S. trade policy in a way that continues to influence current discussions.

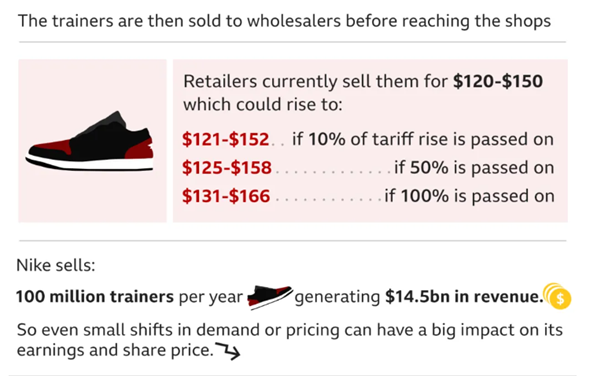

Examples on how this will impact everyday prices?

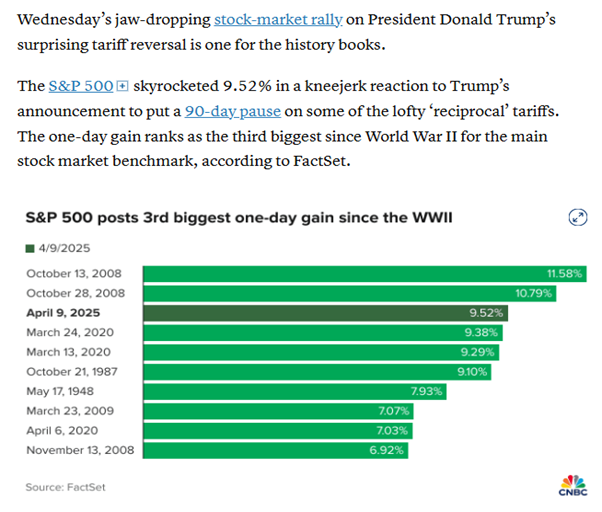

Then comes Wednesday last week and we wake up to another change

Artificial Intelligence (AI) and Computers

In today’s fast-paced world, news and information are delivered at an unprecedented rate. The use of AI in computers enables traders and investors to react to data and facts more swiftly. The prevalence of rules-based and computer-based trading, which was not as common 10 or 20 years ago, has led to quicker and more decisive reactions from traders. This contributes to market volatility as individuals respond not only to the information but also to the resulting market movements.

Our increased connectivity through social media has further integrated markets, with investment markets constantly being recalculated, adding to the volatility. The rise of index-based investing has also amplified upward and downward trends.

I believe this has significantly impacted the way markets operate.

So what does all this mean?

Inflation and interest rates

If tariffs push inflation higher, you might expect interest rates to stay higher for longer, but markets have actually moved in the opposite direction in recent days to price in a faster pace of cuts. Central banks have to balance inflation and growth concerns. Seemingly, markets are more concerned about recessionary risks.

Economic growth

Australia is in a better position than many other economies, having been slapped with the baseline 10% levy. However, many businesses will still feel the impact. Furthermore, higher tariffs on China and the rest of southeast Asia will impact their growth and consumption which will impact Australian exports to the region.

The sad reality is that wages may grow more slowly and redundancies could rise.

Mortgage rates

If interest rates are cut more quickly to counteract slowing growth, mortgage rates could come down. We are seeing early signs of this already.

Savings rates

Savings rates will probably fall further in anticipation of faster base rate cuts.

So why is the US so influential when it comes to global markets and trade?

Short of giving a full lecture on economics, we’ve seen events like this before. The GFC in 2008 was essentially fuelled by the collapse of the US housing market but it sent shockwaves around the world. Markets crashed and Australia was one of the few western economies that avoided a full-blown recession.

Post World War II, the US dollar became the “international” reserve currency. International trade has since generally been settled in US dollars. This has had its pros and cons for the states. It gave them more bargaining power in trade and meant banking and financial services in the US were now critical in the functioning of global trade. The double-edged sword was the demand for US dollars, and other countries (think China) desire to hold it as reserves.

This contributed to the large trade deficit in the US and the increasingly large interest payments it has to make on these debts.

But do not forget that the US still had to purchase goods to run the debt up. The US is the largest single consumer market in the world and countries like China have targeted it over the last few decades.

This may all be about to change. We could see a restructuring of global supply chains, trade routes and consumer preferences. Typically, protectionism is bad for the global economy. It increases prices and decreases efficiency. The president is trying to bring back manufacturing jobs to the US, but this will be easier said than done. The US imports sneakers from Vietnam, white goods from China, microprocessors from Taiwan and electronics from Japan and South Korea. The challenge of bringing these jobs back to the US lie in wages, training, logistics and inputs. It may be possible, but it will take a very long time.

Thursday 10th of April

Trump has now pushed back the start date on the proposed tariffs. Tariffs in excess of 10% on all nations have been paused for 90 days to encourage nations to go to the negotiating table. All, except China, which saw tariffs increase to 125% as both countries appear to be gearing up for a trade war.

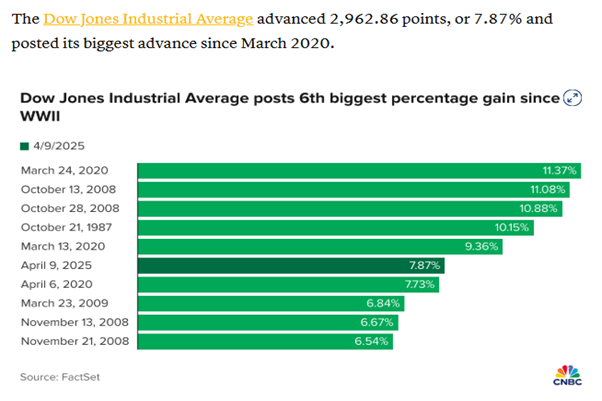

We’ve seen markets bounce back overnight with the Dow Jones climbing 7.87%, the S&P500 9.52%, the Nasdaq 12.16% and the ASX200 with 4.61% but still moving.

Despite this, we do not appear to be out of the woods just yet. While the 90-day pause is a welcome reprieve and it is encouraging that the Trump administration is willing to negotiate, there is still a great deal of uncertainty around the situation. The global business community remains unsure of the cost pressures that they will face in the months ahead which will likely result in a reduction in investment and expansion, at least until there is clarity.

The US is still looking at an effective tariff rate of around 20% which will drive prices up and may still affect supply chains.

Some tips for long term Investors

Here are some tips for long-term investors during market volatility. By following these tips, it will help you to navigate market volatility with resilience and stay on track to achieve your long-term investment goals. If you are concerned about your portfolio’s though, you should seek advice from a qualified financial adviser.

- Sleep Test: If market volatility is causing you too much anxiety and affecting your sleep, it might be worth considering how your money is invested. Your health is more important than your money.

- Diversification: Ensure your portfolio is diversified. This means spreading your investments across different asset classes to reduce risk. A well-diversified portfolio can help mitigate the impact of market volatility.

- Rebalancing: Regularly rebalance your portfolio to maintain your desired asset allocation. This can help you take advantage of buying opportunities when the market dips and ensure your portfolio remains aligned with your investment goals.

- Income and Growth: Separate income and growth components within your portfolio. This allows you to draw on income components (such as interest and dividends) to top up your cash buffer during market downturns, reducing the need to sell investments at a loss.

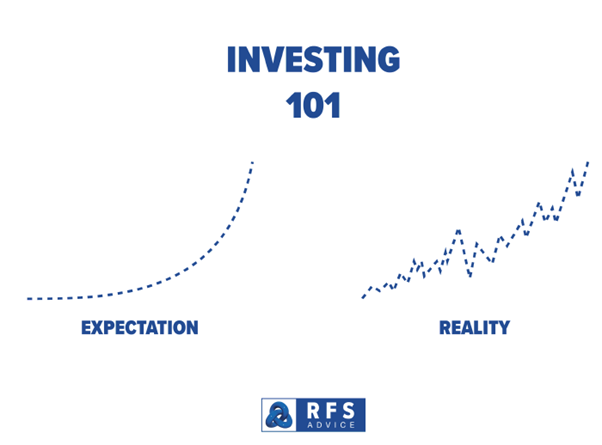

- Stay Invested: Avoid making tactical or short-term changes to your well-considered investment plans. Trying to time the market can be challenging and often counterproductive. Focus on time in the market rather than trying to time the market. Staying invested over the long term can help you benefit from market recoveries and growth.

- Long-Term Perspective: Focus on the long-term rather than short-term fluctuations. Understand that market downturns are normal and part of the investment journey. Maintaining a long-term perspective can help you stay the course and achieve your financial goals.

Here is a great example of the difference between short and long term returns. The following charts show first the Dow Jones Index over a 5 year period and then a 6 month period.

Dow Jones 5-Year Returns:

Dow Jones 6 Month Returns:

Some interesting charts to remember during these volatile times.

Ask Troy a Question.

Simply fill in the below form with your question and we will get back to you shortly.