Ladies we need to talk!

- Many of those who have retired over the last few decades have grown up where it was common for the men to handle the financial decisions and look after the investments. This creates a problem for surviving spouses who are left to deal with the loss of their partner, plus take on the burden of unfamiliar financial decisions.

- Many of those who have retired over the last few decades have grown up where it was common for the men to handle the financial decisions and look after the investments. This creates a problem for surviving spouses who are left to deal with the loss of their partner, plus take on the burden of unfamiliar financial decisions.

- Many of those who have retired over the last few decades have grown up where it was common for the men to handle the financial decisions and look after the investments. This creates a problem for surviving spouses who are left to deal with the loss of their partner, plus take on the burden of unfamiliar financial decisions.

- Personally, we believe the best approach is to educate and support the women that find themselves in this position, to help lift the burden and allow them to grow in confidence when managing money.

- We understand how difficult it can be for women who haven’t looked after the financial affairs to be thrust into the driver’s seat, and we appreciate how daunting this can be. To help support women, we have created an all-female advice team within RFS Advice, who are able to support and guide them through the journey.

- At RFS Advice we have our regular gatherings titled, “Ladies we need to talk” where Brooke, Niki & Belinda discuss a wide range of topics designed to support women.

- Due to the success of this dedicated team, I thought I would share some of insights and findings.

Why did we start this program?

It came from experiencing firsthand with our clients and helping them deal with losing their partner or a divorce and the additional support they were seeking. In our experience, we felt that women would feel more comfortable with another female in the room and allowed the conversation to go to a deeper level.

In that instance we would always have either one of our all-female teams or for myself, I would bring Brooke (fully qualified adviser) from my team to ensure there is enough female opinions represented.

For most people to be honest it is more about the support than the specific advice.

Why is it important to bring women together?

- We have had clients tell us that they are concerned about how many of their friends have no idea what their living expenses are, when their bills are due or how to access their bank accounts. If anything were to happen to their spouse (who is the one who takes care of these things), their friends would have no idea and feel powerless.

- It can feel so isolating, and people can feel embarrassed to say they do not know a lot about their finances. Creating an environment where people can come together and listen, learn and understand is very powerful and creating women only events led by our all-female team seems to create a safe environment. By bringing together people who are in a similar situation or have gone through something similar, promotes a combined sharing. This is powerful.

- One of the most important and sometimes the hardest thing to get across, is that we have no judgement and there are no such things as silly questions. We are happy to talk over all sorts of issues as we have most likely helped someone through a similar situation. Our experience, combined with our empathy and understanding, is a powerful combination and this is what we bring to the table. Our team love helping people, it’s in our DNA.

What things do you normally discuss?

- The first part is always about, are you ok? Ok, with where you live, the income you need and an approach for the future. This is the foundation to help you move forward.

- We then like to help them feel some control over the assets that they have and work through what realistic expectations they should have. It’s also a great time to simplify things and help educate as we find too many people try and impress by complicating things. We believe in simplifying things, so they understand and through this understanding they gain confidence. This is about putting them back in control.

- Once we have this in place we work on some goal setting and have regular meetings to help them work through this. This is about looking to the future with realistic goals and dreams.

- Then we like them to come in as often as they need but at least twice a year to make sure everything remains on track. We can take care of so much more than just the financial side. As with all our clients, we are only ever a phone call away and our approach is to always be the first phone call they make with looking to make an important decision.

I can picture a client who I used to see with Niki at her home in Brisbane, and she always had cheese and crackers laid out. Fast forward a number of years, this client is working with Niki and her team and they spend a good part of their meeting chatting over lunch about her travels, the kids, grandkids and its conversations like these that seemly have nothing to do with finances that can be the most beneficial. This client has moved through the stages and is in the goal setting and looking into the future stage, which is a very special thing to be part of.

It is brave to reach out to someone for help, but it’s that help that allows you to move forward. So much of an advice relationship is not about the money as financial success looks different to everyone. Understanding the essence of what is important to someone runs deeper than surface level conversations about their assets and income.

Helping educating people is clearly a key part of the strategy, how do you help these ladies better understand their financial future?

- Everyone comes to us from a different starting place. That is totally OK.

- We are the professionals in the room, and it is our role to help bring them along for the journey. We can explain and provide as much or as little detail as needed and for everyone this is a little different, and we think that is ok.

- We have one client who manages their own direct shares and absolutely loves this, and the detail involved, but we also have others who log in and check their investments once a month or only when we catch up and bring along the reports.

- Everyone has a different level of interest and understanding and that is ok.

When a new client comes in, do you find everyone has been trying to provide them advice on what they should be doing?

Absolutely. They always say my son or daughter wants me to do this or I was talking to my friend or neighbour at a BBQ and they are doing it this way. That is a common theme.

Everyone is happy to offer free well-meaning advice. Everyone wants to provide you with advice on what you “should do.” We undertook a bereavement and counselling course on “do not let everyone “should” all over you”. That is, everyone will tell you what you should do. Ultimately people need to recognise through a life changing event that it is ok for things to be foggy for a while. There is no right or wrong when dealing with bereavement.

We are here to help you through that time and then when things start to become clearer, we tend to start to frame the conversation around goal setting and the future.

Q. When do you find women make the decision to see a financial planner. What triggers do you normally see?

There are a few major triggers for people to seek advice. In our experience, it’s usually one of the following:

- Divorce – wanting to take control

- And get an understanding of what their financial position will look like going forward, as well as the reassurance they will be okay financially.

- When their husband may have been diagnosed with a significant illness and trying to gain peace of mind.

- When their partner passes away.

- Or in the situation where their current adviser talked to their husband and not them. An interesting one, which we can’t believe happens.

Q. How often do you have a couple come to see you as one may not be well.

This sadly happens more than you would think.

It is not always at the time of someone being sick, rather it’s knowing there is a plan B should something happen. It may not be for now, but it provides great comfort knowing they can decide together, and should their situation change they know the course to take.

It provides the peace of mind (for both) partners that comes with knowing that the other partner feels confident in taking over control of the financial decisions and investments. (Thank you to the 4CRB listener that came in for this and they even helped me with a docking rope for my pontoon boat)

For the partner with declining health there can be a great deal of value and comfort in being able to be a part of the process of selecting and establishing a relationship with a professional adviser, who will be there to assist their partner when they are no longer around.

The ideal situation is to have that advice relationship and team in place prior to there being a trigger event.

Q. What happens if people don’t sort these things out? What do you see in your experience.

Widowers that are women typically take a number of years post their partners death to seek financial advice. Usually by this time their assets have declined significantly (market movements or through normal expenditure), and they feel desperate for help – often too late to rebuild the wealth.

The sad part is the emotional strain the widower is going through and knowing we could have helped, if only they would talk with us or any high-quality financial planner.

What Common things have you seen?

- Overly aggressive or conservative investments without realising this is the case as the other partner said everything was okay (and maybe it was years ago but not anymore).

- Not understanding the importance of an appropriate asset allocation and that this needs to be reviewed regularly.

- Without the support and guidance, a financial adviser can provide, they are more likely to be a victim of a scam or seeking assistance from unlicensed sources.

- In the worst cases, we have seen the impact of children taking advantage and making decisions that may have not been in the best interest of their parent.

What are some top tips for our ladies listening today

- Pick up the phone and reach out for help. There are lots of great advisers out there to help.

- Always trust your gut if you do not feel comfortable with the current relationships or advice.

- Go seek another opinion until you are comfortable with the answers and the direction.

- It is your life savings, so we always want our ladies to feel confident and in control.

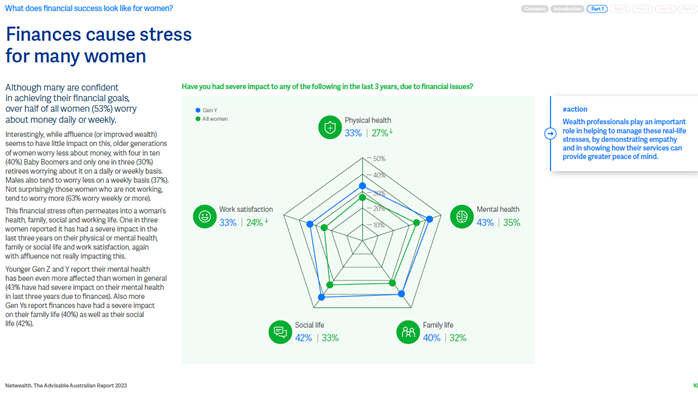

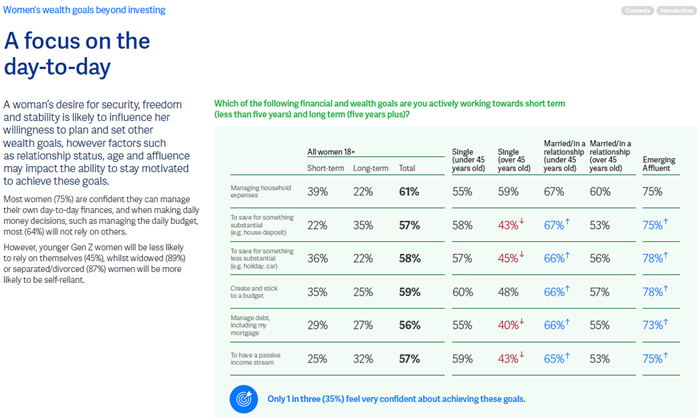

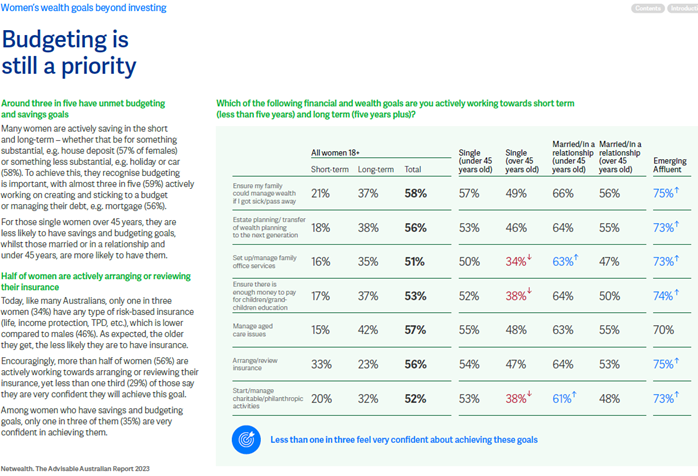

The below information provides some interest insights in finances for women.

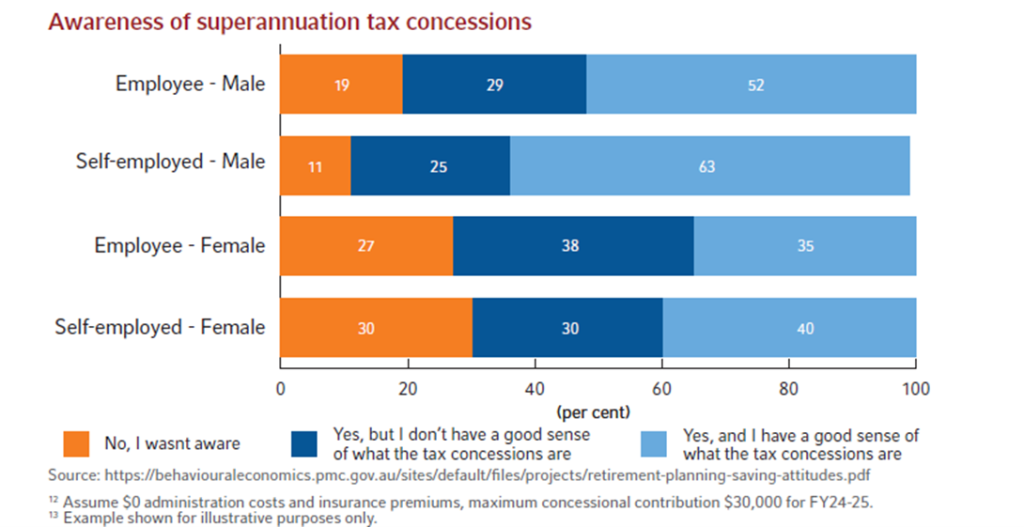

Many Australians still aren’t completely aware of the potential tax benefits that can be derived from superannuation. Super is a great tool for building up a retirement fund but it can also be used as a tax vehicle to derive substantial benefits from.

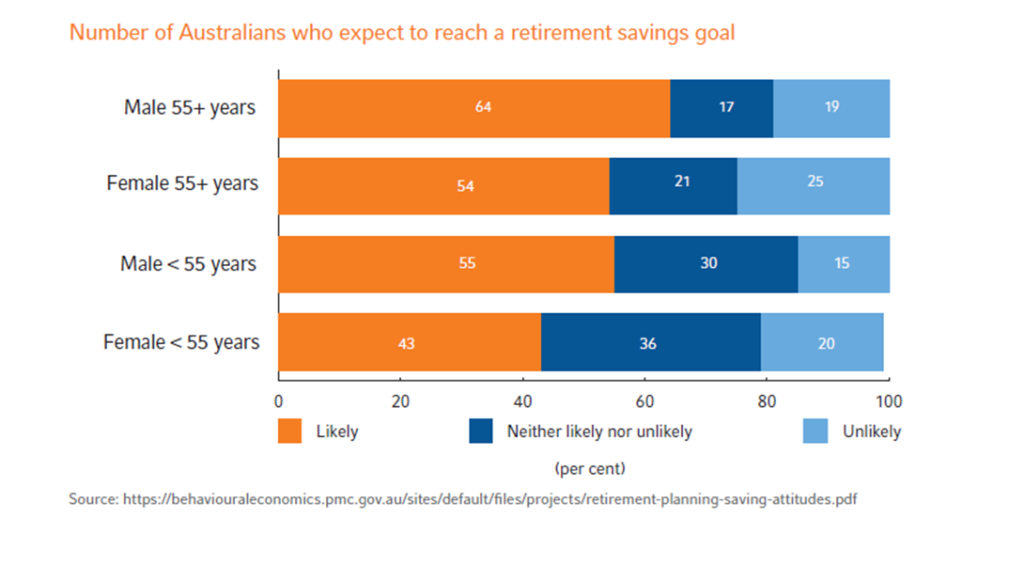

Further to this, many Australians are not entirely confident that they will reach their retirement goals, particularly women under 55 years old.

Source: 2024 Adviser Study courtesy of Russell Investments.

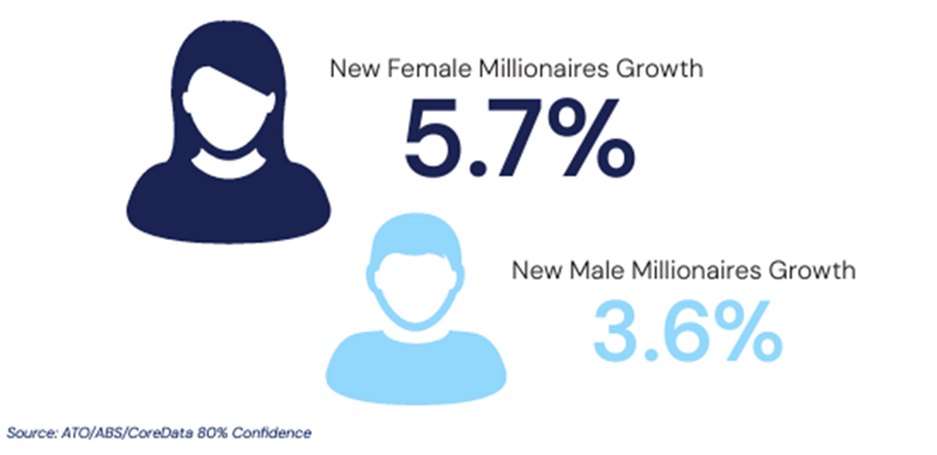

Despite that women may be less confident that they will reach their retirement goals, wealth is shifting. The number of high net wealth women in Australia has been steadily increasing, with nearly twice the growth in the number of new female millionaire’s vs male.

Some factors contributing to this growth are increased work-force participation, including highly paid positions, surging female entrepreneurship and inter-generational wealth transfer.

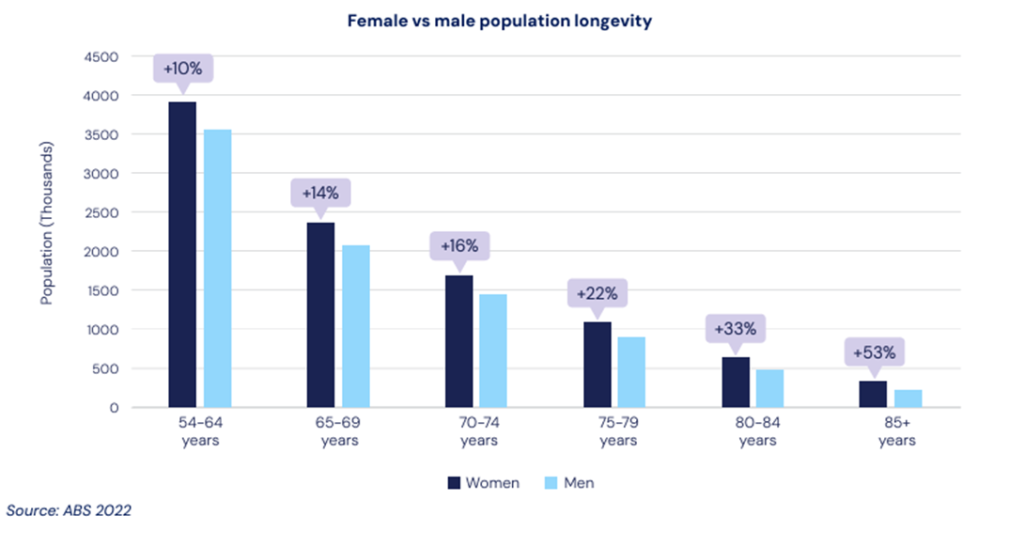

When it comes to inter-generational wealth, women are poised to take custodianship of $3.2 Trillion in the next decade as Australia goes through the greatest wealth transfer in its history.

Not only will the Baby Boomers transfer large sums of money, but it is also projected that for the next two decades, post inheritance women will oversee family finances as they outlive their partners.

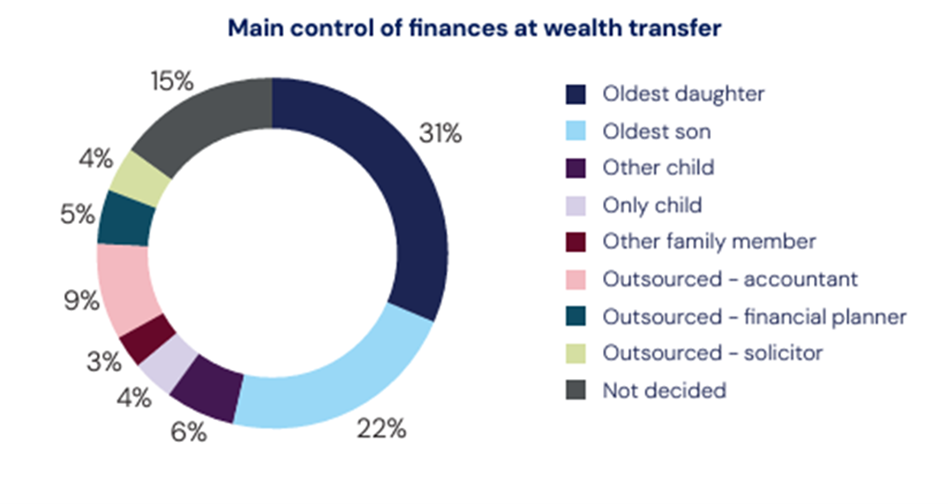

Further to this, research indicates that the oldest daughter is most likely to manage the family finances at the point of transfer (as well as also being 50% more likely to shoulder the burden of managing the family’s estate).

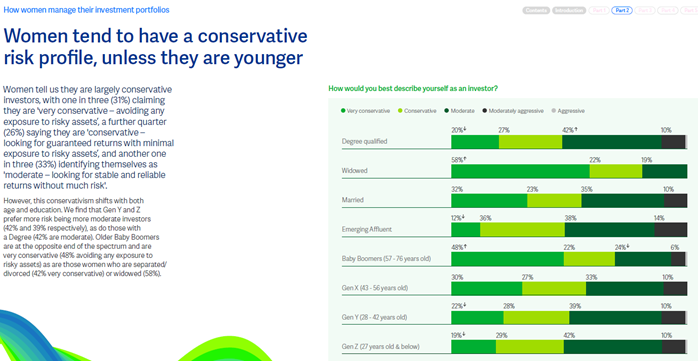

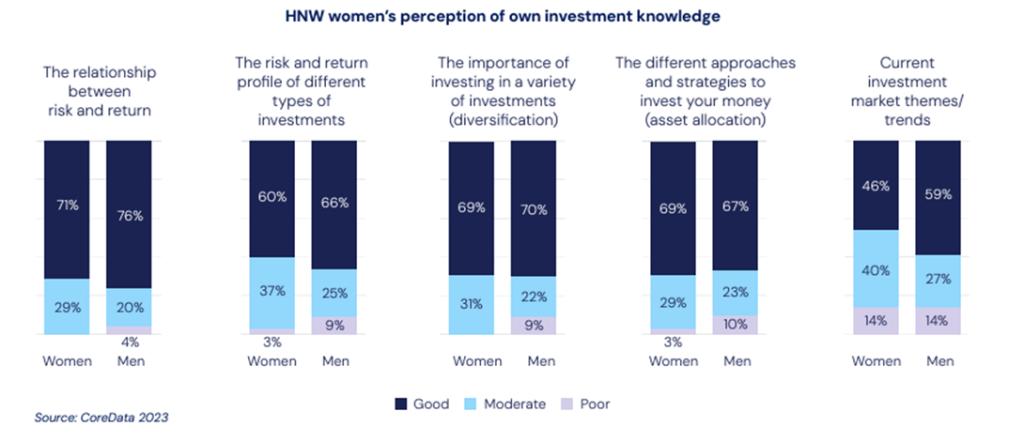

How do women see themselves as investors?

And how do women perceive their understanding of different area’s of investing compared to men?

Source: JB Were – Growth of

Ask Troy a Question.

Simply fill in the below form with your question and we will get back to you shortly.