Is 2023 going to be the year to get your financial world in order?

Setting your goals:

Firstly you need to set some goals. When most people think about a New Year’s resolution they think of the typical things like “I want to lose weight”, “I want to pay off my credit card” etc. People state these and might have good intentions to achieve them and might actually make a start for the first month or two but then lose track and easily forget about it.

Having a New Years’ resolution with a goal and plan attached to it will help make it more achievable. Having a think about a genuine goal that you really want to aspire to in 2023 and then setting some parameters around it will provide you with a focus point and direction.

Whilst the typical New Year’s resolutions are a great start, have you really considered, what is important to you and what do you want to achieve in life? Have a think about some of the following that could actually provide you with fulfilment and happiness.

How to make a fundamental meaningful difference this year.

- Will you retire in 2023

- Where would you like to visit

- What sporting events or concert would you love to attend

- What hobbies have you always wanted to pursue

- Family experiences you would like to provide

- Health milestones you would like to achieve

- Is there places you would like to live for an extended period of time

- Is there something you have always wanted to own

- Challenges you would like to conquer

- Goals you have achieved in the past that you would like to achieve again

2022 was a year with many challenges and having a goal that you are wanting to achieve will help keep you positive and focused.

If you need any inspiration around how to achieve your goals, look at Richard Branson and his thoughts on goal setting. He is a firm believer in writing his goals down. He has five simple steps that he believes helps him stay directed to achieve his goals:

- Write down every single idea you have

- Have a few lists

- Mark off every completed task

- Make your goals measurable so you know if your plans are working

- Share your goals with others

Once you have identified your goal, you need to consider how you will afford to do these:

- Do you know how much your household spends each year

- Do you know how much each of these dreams will cost

- Do you have the financial means to do some or all of them

This is where we can help our clients achieve their goals.

Having a financial plan:

When was the last time you reviewed your financial plan? Do you even have a financial plan in place?

We help clients every day with working through their financial position to identify ways to help clients live their best life.

Generally this starts with identifying your income and expenses. We’re not going to talk about the scary “budget” word as people hear “budget” and think we’re going to tell people how to spend their money. That is not what budgeting is about.

Budgeting is having a look at your cashflow to identify where you are spending money and analysing whether you have surplus funds that could be better directed to help you achieve your set goals.

It is purely up to the client as to whether they want to change their spending patterns. We are here to help you consider how to make your goals achievable, we’re not here to tell you how to stop living. Actually, it’s quite the opposite. We want to see our clients achieve their goals and dreams, as that’s what it’s about and that’s what is important to us.

There are many ways you can complete your budget. There are online tools, spreadsheets or simply going through your bank statements to collate your living costs. We can help with what people see as a frustrating and sometime daunting task, yet we do it every day.

From there we work on what you need to live on and we ensure that you have adequate cashflow to cover at least 1-2 years of living costs.

Achieving your goals:

We have been privileged over the years to work with many clients and watch them achieve their goals that they thought might have been unrealistic or unachievable. Our client dreamboard is a reflection of this and it helps to not only inspire us but inspire other clients to perhaps “write that goal down” that they maybe once thought might have been impossible.

Our clients send in photos proudly showing their achievements. Our board includes amazing places that they’ve always wanted to see, cars and other toys they’ve always wanted to own (or build!), family experiences they’ve always wanted to do, fitness/sport challenges they’ve always wanted to participate in either in Australia or overseas just to name a few.

We had one client that had a goal of owning a catamaran. When he met with us, he was in a position that he could have purchased it but his living costs may not have been as comfortable as they could have been based on their desired living costs. He decided to work for just one more year and he then made his dream a reality, purchased the boat and is still happily enjoying his retired life some ten years later.

We have had a number of clients that decided they wanted to travel in retirement and when we say travel for these clients, we don’t mean having a must see country, we mean travelling around both Australia and Overseas for up to 6 months of the year. We’ve had clients buy the caravan and travel around Europe for 6 months of the year and they have seen some amazing places. That was their dream and with planning they were able to achieve it.

One client’s dream was to watch the Formula One race in Germany but was worried about spending the funds and how this would affect his long term retirement plans. We worked with him to show how this could be achievable and many years later he is still reminiscing about the experience that he didn’t think would ever be possible.

This is the power of having a financial plan and ensuring you stick to your goal to make your dreams a reality. It also highlights the importance of working with someone to help you plan.

A strong financial plan allows you to know you are on track and going to be ok. There is too much short term decision making in the world and we believe in working with you closely to explore achievable goals for you and then reviewing these with you to make sure you are on track.

What’s stopping you from achieving your goals?

There are many reasons that can prevent people from achieving their goals and we believe some of the below reasons are why a lot of New Years’ resolutions discontinue after a short term:

- People lose interest

- There is a lack of commitment or they become ‘so busy’

- Having too many goals

- No measurable plan

- Goals are unrealistic

- Paralysis at the first step

- Excuses

- Procrastination

- Fear: Fear of failure, fear of success, fear of getting out and actually doing it, fear of being able to afford it and fear of running out of money

All of these reasons are things that potentially can stop you from making many great things happen.

We asked a number of or retiree clients around goal setting and the answers varied from “We have set specific goals and look at them regularly” to “I do not want to set a New Year’s Resolution”.

The best tips that we have for new retirees are:

- You need to retire to something not retire from something.

- Initially set one job per day

- Be open to new ideas and hobbies

- Be brave and say “no” to things you do not really enjoy

- Be brave and say “yes” to things you have always wanted to try

This is why goal setting is so important and can help lead a fulfilling life during retirement.

Investment market conditions can also have an impact on goals as clients naturally will have concerns on their portfolio balances and then worry about spending money. Markets will have cycles and 2022 was a tough year. That is not the normal, in fact nothing was normal in 2022. You do not manage for the exception, you manage for the long term.

Too many people spend their time worrying about markets every day and we recommend to not let investment markets control your mood or your life and a part of what we will do is to help educate on the investment markets and to help alleviate anxiety and stress around adverse market conditions.

We help retirees that want their portfolio to deliver their desired outcome to allow them to live their ideal retirement and life. We want to help them build in more safeguards to allow markets to do what they do to allow them to do what they want to do.

2023 will have ups and downs. It is how you deal with them that will determine your outcome.

How we can help:

We do more for clients than just place investments, review your super or pension fund or insurance policies.

We will work with you and be your educator to help you understand what is involved to meet your goals.

This will involve setting realistic goals and putting the right strategies in place so that you have confidence knowing that you are on the right track.

Can you do this on your own…maybe? What we find though is that many people find they either don’t have the time, don’t know how to do it and are concerned that they won’t stay on track and then their goal ends up being like their New Years’ resolution…forgotten.

Using our knowledge and expertise we will develop a personalised financial plan and review this with you over time to ensure that you are heading and staying in the right direction.

We are passionate about working with clients from all stages in life whether that be wealth accumulators, pre-retirement or retirees. We believe that it is never too late in life to achieve your life dreams or goals and we want to help make this a reality for you.

In 2023, we encourage you to make your New Year’s resolution be the year that you set your goals in motion and make it happen.

If you would like assistance in how to make this a reality for you, please jump on line and book in with my team. They will spend an hour with you at no cost or obligation to check if you are ok.

Market update – January 2023

Interest Rates:

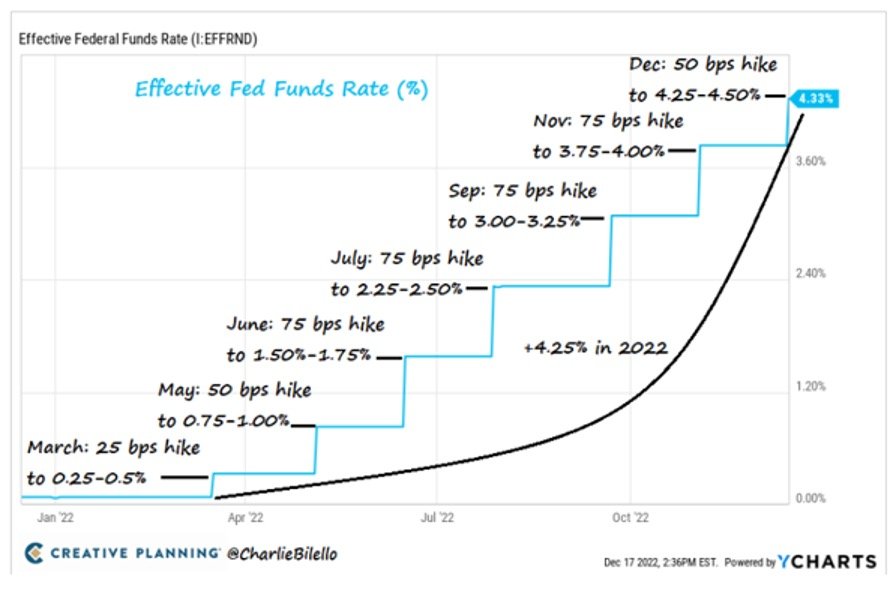

We are likely to see more rate hikes in 2023, adding to the seven hikes in 2022. The year-end Fed Funds Rate of 4.25%-4.50% exceeded all expectations (the Fed itself had only predicted a 0.9% year-end rate as its December 2021 meeting), and was the highest we’ve seen since December 2007.

US Bond Returns:

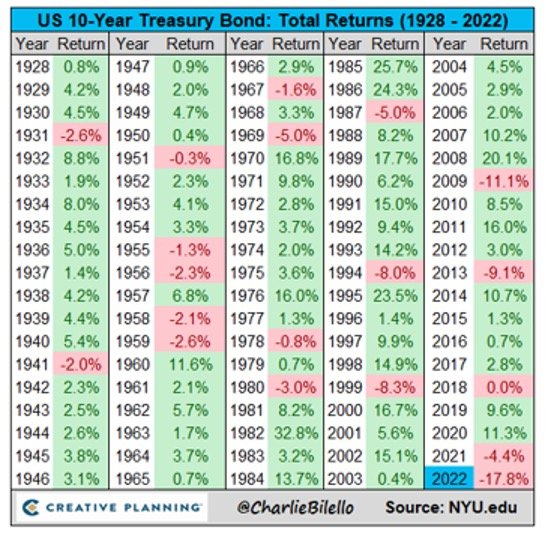

The 10-Year Treasury bond finished down 17.8%, its largest decline ever with data going back to 1928.

Share market returns:

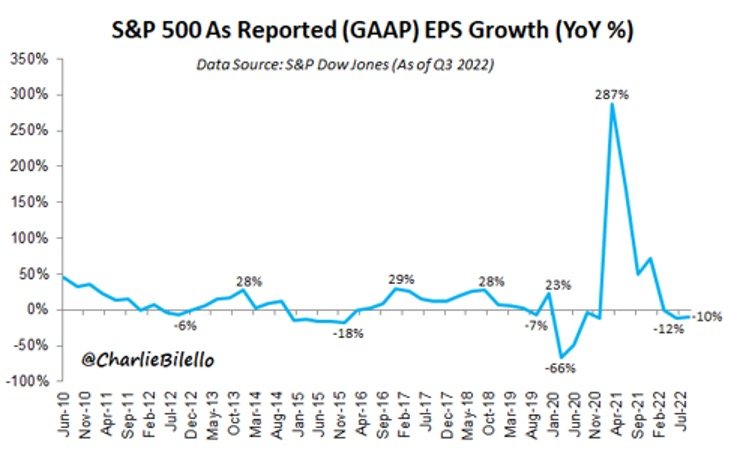

Facing tougher comps and margin compression, earnings declined in both the second and third quarter, down 10% year-over-year.

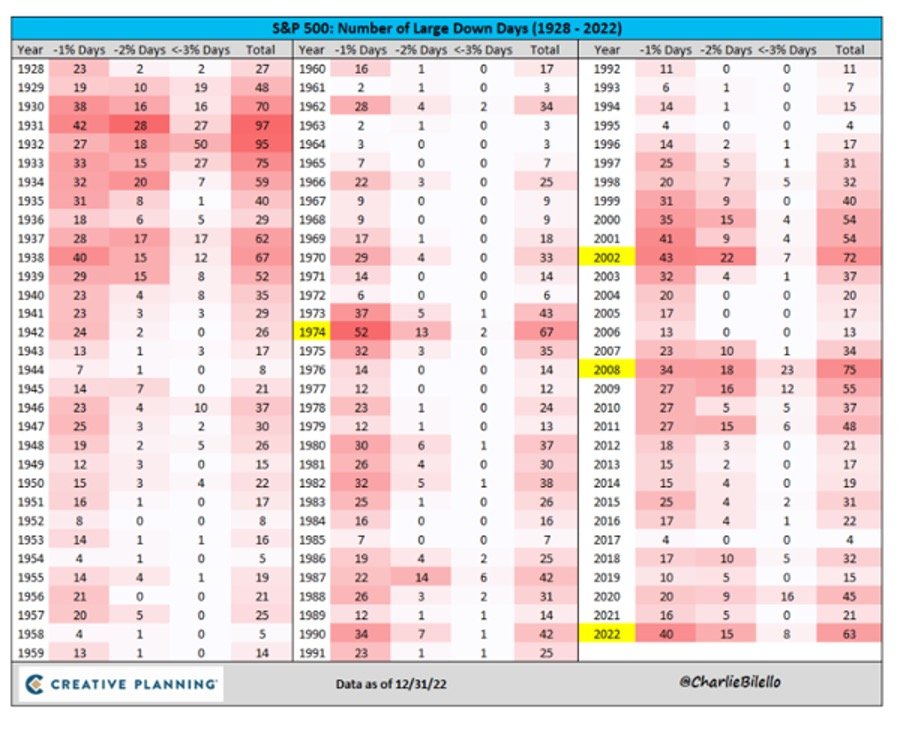

The S&P 500 would fall more than 1% on 63 trading days during 2022. Since 1940, the only years with more downside volatility: 1974, 2002 and 2008.

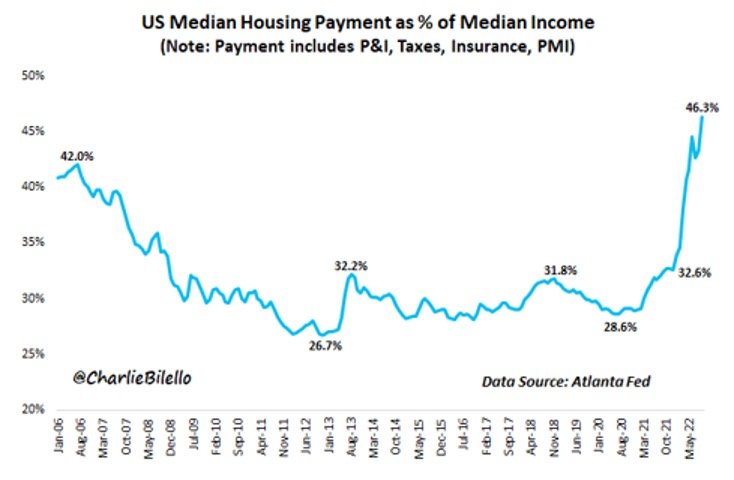

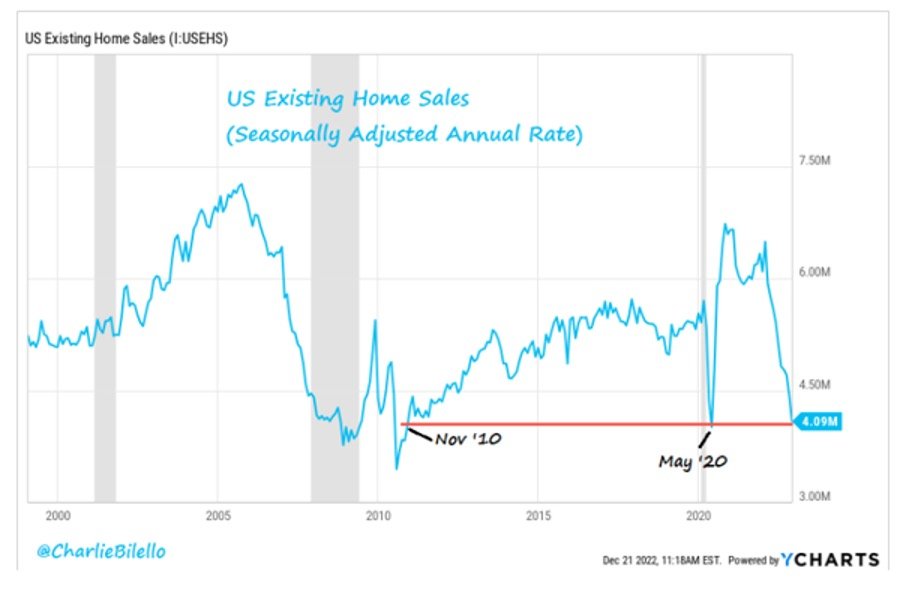

The combination of skyrocketing prices and skyrocketing mortgage rates made housing more unaffordable than ever before.

What followed was a collapse in demand, with sales activity plummeting.

And then with a lag, prices began to fall. The median sales price of an existing home is down 10% from its peak in June.

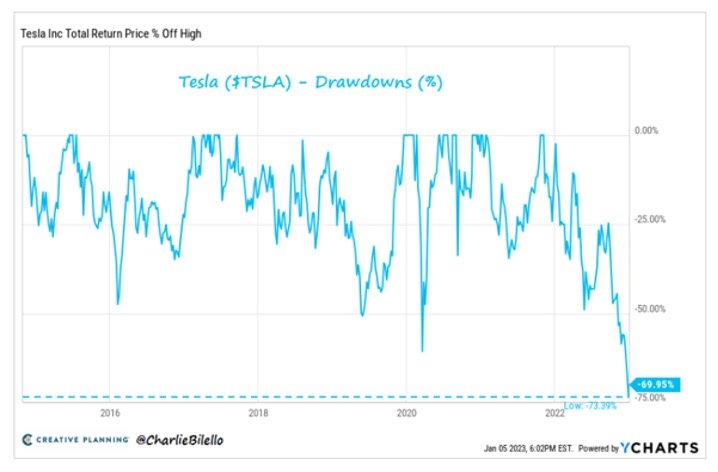

No single stock has embodied the FOMO boom more than Ark’s largest holding over the past few year, Tesla, which rose an astounding 743% in 202 (versus a 28% increase in its sales). But like other highly valued growth stocks, Tesla was not immune to the laws of gravity, and has suffered a drawdown of over 73% from its peak.

We’ve also seen freight rates from China to West Coast down 90% as global trade falls off fast.

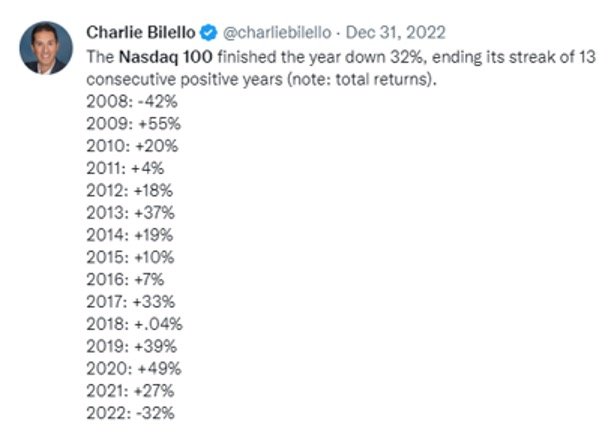

The Nasdaq 100 finished 2022 down 32%, ending its streak of 13 consecutive positive years (note: total returns). The big four (Apple -26.4%, Microsoft -28.0%, Google -39.1% and Amazon -49.6%) all finished lower and underperformed the broad market, something we haven’t seen since 2008.